The biosimilars market, currently small and focused on a few disease areas and countries, is likely to grow considerably over the coming years, particularly in the US and emerging economies such as Brazil and South Korea. An analysis by IMS Health indicates that while this situation is potentially highly lucrative, careful planning and negotiation by producers will be required to make the most of the burgeoning markets [1].

Biologicals are drugs based on large complex molecules produced by cell culture through recombinant DNA technology and include recombinant insulin, growth hormone and monoclonal antibodies for the treatment of conditions such as cancer and autoimmunity. Their production, testing and quality control is an expensive process, and hence they represent some of the most costly pharmaceutical products. Nonetheless, they accounted for 16% of global pharmaceutical expenditure, with sales reaching US$138 billion in 2010.

The US is a key market that biosimilars producers need to tap into in the coming years, representing around 60% of the potential market. This trend is being driven by the imminent expiry of patents on many key biologicals over the next five years, including monoclonal anti-tumour necrosis factor antibody, used for the treatment of rheumatoid arthritis. Facing the loss of sales from brand-name products, the pharmaceutical industry, generics manufacturers and biotech companies are turning, for future revenues, to biosimilars R & D.

Take an example, Amgen, recently engaged PRA as the sole CRO to develop a series of phase III studies for several biosimilar drugs on a worldwide basis, and entered into an agreement with Watson to collaborate on the development and commercialization of several cancer antibody biosimilars. Other companies like Pfizer and Merck have a biosimilar programme installed.

A second factor in the US is the global financial crisis, which is pushing western nations to impose ever more stringent means of containing and reducing healthcare costs. Switching from brand-name products to biosimilars will be a key step in achieving lower drug costs.

In the US, the biosimilars market will be supported by a new framework, which will come into force in 2014, as part of the Patient Protection and Affordable Care Act of March 2010. However, the degree to which healthcare providers and payers demand a switch from brand-name originators to biosimilars will depend on several determinants:

- Price: originator companies will need to anticipate how biosimilars will affect pricing and hence discounting through contracts.

- Established experience: the precedent already set in Germany for using biosimilar erythropoietin and granulocyte colony-stimulating factor means that these products are likely to be accepted quite readily in the US. In contrast, providers and payers may need more convincing when it comes to biosimilars for autoimmunity, for which safety and efficacy has yet to be proven.

- Treatment duration: biosimilars for chronic conditions such as rheumatoid arthritis and psoriasis are likely to come under closer scrutiny from payers who face a large treatment bill over a patient’s lifetime.

- Familiarity and trust: patients and their prescribers will have to build trust in the safety and efficacy of biosimilars as alternatives to the brand-name products with which they are already familiar.

- Uncertainties over pricing: co-payment tiers and contracting will all affect projections of how well a particular biosimilar product will fare in the US.

- Patients: involving patients as stakeholders in treatment decisions and co-payment plans will also affect the uptake of biosimilars.

While patent disputes and stringent clinical and regulatory requirements may slow the process to approval for biosimilars in the US, building financial incentives for both payers and patients will be key to the growth of the US biosimilars market over the long term.

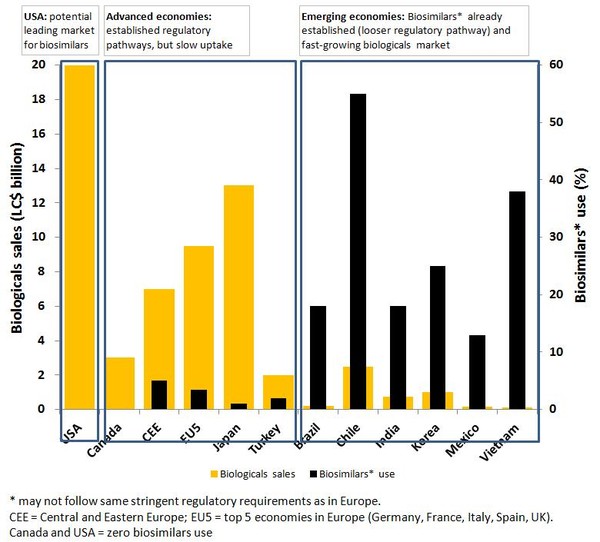

In emerging economies such as Brazil, China, India, Mexico and South Korea; growing populations and new steps towards widening access to medicines are fuelling demand for low-cost medicines, see Figure 1. These countries feature a less regulated environment with looser definitions of what constitutes a biosimilar, which means easier entry of new biologicals with similar action to brand-name products. This situation is encouraging both local and international producers to invest in biosimilars R & D. Indeed, biosimilars are likely to contribute significantly to economic growth in these countries. In China, for example, alternative products are already on the market with claims of similar action to brand-name biologicals for the treatment of cancer. South Korea, on the other hand, is developing world-class facilities and infrastructure for the manufacture and testing of high quality biosimilars that will meet international regulatory requirements and will therefore present considerable competition to other international producers.

Figure 1: Biologicals and biosimilars use [1]

The biosimilars market may develop along a different course in the US compared to emerging economies, but strong factors are driving demand and development in both types of economies, with biosimilars likely to generate high revenues by 2020.

Related articles

Stakeholders are key allies for biosimilar producers

2020 outlook for biosimilars: opportunities and hurdles

Amgen enters biosimilars deal with PRA

Amgen buys Turkish generics manufacturer

Amgen finally jumps on biosimilars bandwagon

References

1. Shaping the biosimilars opportunity: a global perspective on the evolving biosimilars landscape. IMS Health, December 2011.

Permission granted to reproduce for personal and educational use only. All other reproduction, copy, retransmission or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

0

0

Post your comment