During the Biosimilars Medicines Conference in May 2023, Mr Aurelio Arias from IQVIA delivered a presentation about the biosimilar void in Europe. He highlighted that while the uptake of biosimilars has accelerated, there is a growing disparity in market concentration for smaller biologicals [1].

Omnitrope (somatropin) was the first biosimilar approved in the European Union (EU) in 2006. To date, the European Medicines Agency (EMA) has recommended the approval of 96 biosimilars. Although the approvals of biosimilars have been consistently increasing over the years, they appear to be focused on only a small proportion of the total biological drugs available in the market [2].

There is a greater focus on developing biosimilars for high-value biologicals. This concentration of biosimilar development leaves smaller biologicals at risk of being overlooked, as they may not attract as much biosimilar development. The data suggest that the risk of a ‘biosimilar void’ is higher for low-value biologicals.

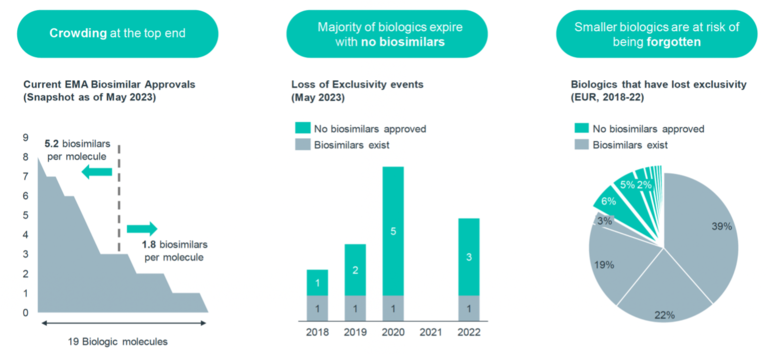

Figure 1: Increasing number of biosimilar approvals concentrated on selected biologicals

Source: IQVIA

Figure 1 shows a snapshot on the current EMA biosimilar approvals as of May 2023. With 19 biological molecules crowding at the top end, this represents an average of 5.2 biosimilars available per molecule for high-value biologicals, and an average of 1.8 biosimilars per molecule for other low-value biologicals.

Taking the example of high-value originator Humira (adalimumab) biological, there are 10 biosimilars approved in the EU: Amgevita (Amgen), Amsparity (Pfizer), Hefiya and Hyrimoz (Sandoz), Hukyndra and Libmyris (Alvotech), Hulio (Mylan/Fujifilm), Idacio (Fresenius Kabi), Imraldi (Samsung Bioepis), Yuflyma (Celltrion). On the other hand, the smaller biological somatropin has only one approved biosimilar.

The situation is even more alarming considering that the majority of biologicals expire without any biosimilars. In 2020, six biological patents expired, but only one molecule has a biosimilar competitor. This situation implies that many originator biologicals lose their exclusivity without the development of corresponding biosimilars to compete with them.

There is a growing trend of biosimilar approvals in the market, but there appears to be a selective approach in targeting specific biological drugs for biosimilar development and approval.

In Europe, from 2018 to 2022, 13% of biologicals that lost their exclusivity did not receive biosimilar approval, primarily due to their smaller size.

The biosimilar market in Europe is the world’s largest, accounting for around 60% of the global biosimilar market and experiencing consistent growth year-on-year. However, corresponding policy for a sustainable biosimilars market in Europe is recommended [3].

Related articles

Biosimilars uptake rates in Europe and the UK

Emerging disparities in market concentration among biosimilars

The successful uptake of biosimilars in Europe and the US

Successful increase of biosimilar adoption in a large integrated health delivery network

References

1. Arias A. Filling the Biosimilar Void. 19th Biosimilars Medicines Conference; 2023 May 25-26: Amsterdam, The Netherlands. Medicines for Europe.

2. GaBI Online - Generics and Biosimilars Initiative. Biosimilars approved in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2023 Sep 1]. Available from:

www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-Europe

3. Reilly MS, Schneider PJ. Policy recommendations for a sustainable biosimilars market: lessons from Europe. Generics and Biosimilars Initiative Journal (GaBI Journal). 2020;9(2):76-83. doi:10.5639/gabij.2020.0902.013

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2023 Pro Pharma Communications International. All Rights Reserved.

0

0

Post your comment