Information from the Patented Medicine Prices Review Board (PMPRB) in Canada details the cost savings that could be made from biosimilars in the country.

Following on from information on sales biosimilars in Canada [1], the Canadian government has also released information on the cost savings that have been and could be realized from the use of biosimilars in the country.

The analysis is based on a number of different scenarios of market entry, uptake, and price discounts and represent an aggregate of the potential savings of biosimilars in the third year following market entry.

The analysis includes 10 drugs in total, see Table 1. Data on availability, uptake and pricing were taken from the IQVIA MIDAS database for Organisation for Economic Co-operation and Development (OECD) countries.

| Table 1: Biosimilars included in the analysis

|

| Medicine

|

2018 sales (CA$ M)

|

Is the biosimilar available in the EU or US?

|

Approval in Canada

|

First sales

|

| Infliximab

|

1,123

|

EU, US

|

01/2014

|

Q1 2015

|

| Etanercept

|

309

|

EU

|

08/2016

|

Q4 2016

|

| Insulin glargine

|

285

|

EU, US

|

09/2015

|

Q1 2016

|

| Filgrastim

|

133

|

EU, US

|

12/2015

|

Q2 2016

|

| Ranibizumab

|

317

|

N/A

|

N/A

|

N/A (launching in 2020)

|

| Rituximab

|

266

|

EU, US

|

04/2019

|

Q4 2019

|

| Trastuzumab

|

186

|

EU, US

|

05/2019

|

Q2 2019

|

| Bevacizumab

|

118

|

EU, US

|

04/2018

|

Q3 2019

|

| Insulin lispro

|

77

|

EU, US

|

11/2017

|

Q4 2019

|

| Pegfilgrastim

|

47

|

EU, US

|

04/2018

|

Q1 2019

|

All prices shown are in millions of Canadian dollars.

N/A: not available.

Source: IQVIA MIDAS Database, prescription retail and hospital markets.

|

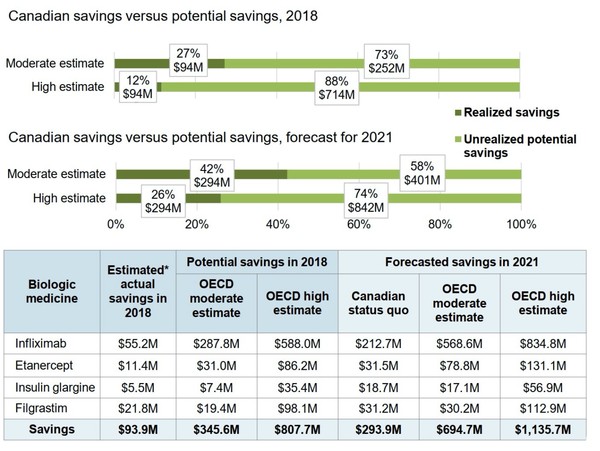

The first part of the analysis relates to the first four items in Table 1. It finds that the use of these biosimilars (infliximab, etanercept, insulin glargine and filgrastim) saved Canada CA$93.9 million in 2018. In 2021, savings will reach CA$294 million (presuming that the uptake trend continues).

The report goes on to demonstrate the extra savings that could be realized by increasing uptake and/or lowering prices. Under a scenario where the uptake of biosimilars matches the OECD median but biosimilar prices remain at their current level, savings in 2018 would have been significantly higher – at CA$346 million. By 2021, savings could be increased to CA$401 million. This demonstrates the importance of good uptake for biosimilars.

If uptake of biosimilars matched the median level for the top four OECD countries and the price in Canada matched the OECD overall median price, 2018 savings would have increased to CA$808 million, increasing to CA$1,136 million by 2021.

These modelling scenarios demonstrate that Canada is only realizing a portion of the total available savings from biosimilars, which is in line with other data showing low levels of biosimilar uptake in the country [2].

Figure 1: Estimated savings from biosimilars in Canada

Realized and potential savings for 2018; projected savings for 2021. Results derived using moderate and high estimates, based on OECD values, as described above.

OECD: Organisation for Economic Co-operation and Development

Source: IQVIA MIDAS® Database, prescription retail and hospital markets.

The second part of the analysis relates to the final six biosimilars in Table 1, which either recently entered the Canadian market or are expected to be available in Canada by the end of 2020. These are in total: ranibizumab, rituximab, trastuzumab, bevacizumab, insulin lispro and pegfilgrastim.

Based on experience with biosimilars in Canadian and international markets, three scenarios were used to estimate the savings from these biosimilars in 2023:

1. Canadian estimate: Assumes that the Canadian price of the originator is discounted by the average Canadian biosimilar discount (30.05%), unless it has a publicly available price.

2. OECD moderate estimate: OECD median uptake is combined with the Canadian prices used in the first scenario.

3. OECD high estimate: Median uptake in the top four OECD countries is combined with the OECD median price. (If no OECD biosimilar price is available, OECD median prices are discounted by the OECD average biosimilar discount of 29.51%).

The results show that savings from the biosimilars could reach CA$447 million by 2023, see Table 2. Savings are highest under the OECD high estimate, followed by the Canadian estimate.

| Table 2: Estimated potential savings of new biosimilars in 2023, Canada

|

| Medicine

|

2023 forecast sales (CA$ M)

|

Potential savings: Canadian estimate (CA$ M)

|

Potential savings: Moderate estimate (CA$ M)

|

Potential savings: High estimate (CA$ M)

|

| Ranibizumab

|

372

|

79

|

54

|

201

|

| Rituximab

|

283

|

59

|

40

|

83

|

| Trastuzumab

|

194

|

46

|

39

|

83

|

| Bevacizumab

|

130

|

30

|

26

|

54

|

| Insulin lispro

|

96

|

3

|

3

|

12

|

| Pegfilgrastim

|

22

|

5

|

4

|

13

|

| Total

|

1,097

|

222

|

167

|

447

|

All prices shown are in millions of Canadian dollars.

Source: IQVIA MIDAS Database, prescription retail and hospital markets.

|

Related articles

Biosimilar infliximab uptake in Canada

The cost of biologicals in Canada

References

1. GaBI Online - Generics and Biosimilars Initiative. Trends in biological drugs in Canada [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2020 Aug 28]. Available from: www.gabionline.net/Reports/Trends-in-biological-drugs-in-Canada

2. GaBI Online - Generics and Biosimilars Initiative.Low levels of biosimilar uptake in Canada [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2020 Aug 28]. Available from: www.gabionline.net/Reports/Low-levels-of-biosimilar-uptake-in-Canada

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2020 Pro Pharma Communications International. All Rights Reserved.

Source: Government of Canada

0

0

Post your comment