A recent analysis of 48 pharmaceutical licensing deals from Chinese to Western companies in 2024 reveals a surge worth US$8.4 billion, with 31% of major pharmaceutical companies' innovative pipeline assets being in-licensed from China [1]. The Nature Reviews Business Brief, written by Leon Tang, examines data from investment bank Stifel’s report, ‘Biopharmaceutical Outlook for 2025’ [2].

Growth drivers of China’s pharmaceutical sector

The analysis highlights that, over the past two decades, China’s pharmaceutical sector has expanded significantly, fuelled by:

- Returning executives from global firms

- A strong pipeline of stem-educated professionals, and

- Sustained government support.

These factors have enabled China to move beyond its traditional strengths in contract research, development, and manufacturing and emerge as a key source of innovative pharmaceutical assets for global markets.

Shift toward early-stage innovation

While China has not historically led in developing first-in-class or best-in-class drugs for Western approval, recent data indicates a shift. Stifel’s report notes that 31% of the innovative pipeline assets licensed by major global pharmaceutical companies were sourced from China.

To assess this trend, the analysis focussed on 48 agreements involving Chinese-developed pharmaceutical assets, including:

- Licensing deals

- Mergers and acquisitions (m&a), and

- New company (newco) formations.

These transactions, with disclosed upfront payments, near-term milestones, and equity investment, totalledUS$8.4 billion, double the US$4.2 billion raised by China-based biotech firms in private investments that same year.

A notable shift was observed in the stage of assets involved. Whereas previous years saw more late-stage clinical assets being licensed, in 2024, early-stage deals dominated: 71% of transactions and 77% of upfront payments were tied to preclinical or Phase I assets. This trend likely reflects regulatory barriers to gaining US approvals using clinical data generated in China, but it also suggests growing confidence in China's early-stage innovation.

Therapeutic focus: complex biologics gain traction

The therapeutic focus is also evolving. While companies like BeiGene and Legend Biotech have historically advanced small molecules and monoclonal antibodies (mAbs), including BTK inhibitors like zanubrutinib and PD-1-targeting mAbs like tislelizumab, 2024 saw increased emphasis on complex biologics.

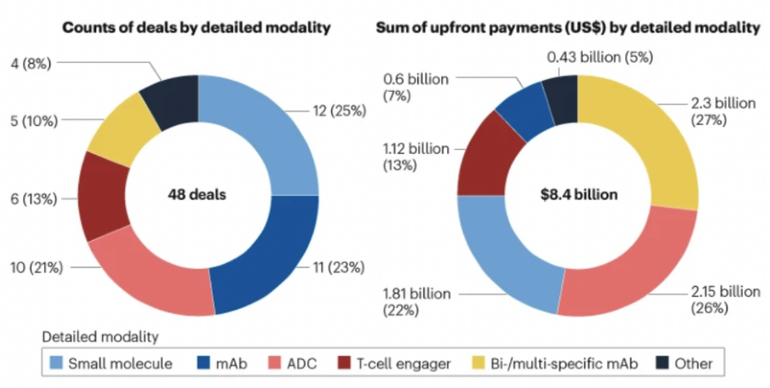

Although small molecules and mAbs accounted for 48% of deals, they represented only 29% of total upfront payments. In contrast, antibody-drug conjugates (ADCs), multi-specific mAbs, and T-cell engagers made up44% of deals but contributed 66% of upfront payments, see Figure 1. This trend indicates a shift toward more complex, next-generation therapeutics. Notably, cell and gene therapies, despite active development inChina, were largely absent from major outbound deals, likely due to global concerns over their commercial viability.

Figure 1: China-to-West deals of complex biologics in 2024

Note: Complex biologics such as antibody–drug conjugates (ADCs), T-cell engagers and other multi-specific biologics contributed to 21 deals (44% of the total) and US$5.6 billion in upfront payments (66% of the total).

Oncology dominates, but other therapeutic areas emerge

Oncology remained dominant, accounting for 55% of deals and 63% of upfront payments. However, other therapeutic areas saw meaningful participation: immunology and inflammation represented 25% of deals and 26% of upfront value, with obesity and cardiometabolic diseases accounted for 10% and 7%, respectively.

Globally, M&A activity in 2024 followed similar patterns, with immunology and inflammation leading at 38%, followed by oncology (32%), CNS diseases (11%), and obesity and cardiometabolic conditions (7%). However, China-to-West deals showed minimal involvement in CNS therapeutics, an area of increasing global focus.

Dealmaking surge amid China’s biotech funding constraints

In terms of dealmakers, Western biotech firms and large pharmaceutical companies were both active, completing 22 and 19 deals, respectively, with total spending of US$3.6 billion and US$4.4 billion. European firms were slightly more active than their US counterparts, closing 23 deals worth US$4.6 billion, compared to 22 deals totalling US$3.5 billion by US companies.

The review notes that, despite the surge in deals, China’s biotech sector is entering a more constrained funding environment. Private investment in 2024 fell to US$4.2 billion, just 28% of the 2021 peak (US$15.7 billion). Most out-licensed assets were supported by funding raised 3–10 years earlier. With tighter IPO regulations limiting investor exits and a lagging presence in key areas like CNS, future innovation capacity may be at risk. However, ongoing global demand for pipeline renewal, driven by patent expirations, the Inflation Reduction Act, and Medicare pricing reforms, means Western companies are likely to continue sourcing cost-effective innovation from China.

Related articles

Meitheal expands portfolio with three biosimilars through exclusive US licensing agreement

International biosimilars players expanding their presence in China

China’s Hasten Biopharma acquires 14 products from Celltrion

References

1. Analysis of China-to-West pharmaceutical licensing deals in 2024.

https://www.nature.com/articles/d41573-025-00068-0

2. Biopharmaceutical outlook for 2025.

https://www.stifel.com/newsletters/investmentbanking/bal/marketing/healthcare/biopharma_timopler/2025/BiopharmaMarketUpdate_Outlook_2025.pdf

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2025 Pro Pharma Communications International. All Rights Reserved.

0

0

Post your comment