With six biosimilar compounds in the works and two launched in the Indian market, India's second largest generic drug maker – Dr Reddy's Laboratories – is negotiating with several multinational companies to broaden its presence in Western markets. The unveiling of a deal that may span from sharing regulatory and manufacturing expertise to distribution and detailing could be expected some time next year (in 2010). But the task of taking biosimilar drugs into developed markets will be tough and expensive as regulatory agencies will likely seek submissions on non-inferiority clinical trials that will be large-scale, typically involving close to a thousand patients or even more.

“We are not very confident of building all of the operations in biosimilar products on our own. We will go the partnership route with Western companies and that could be a win-win opportunity for both,” G V Prasad, Chief Executive at Dr Reddy's Laboratories, revealed at a conference organised by PharmAsia News recently in San Francisco. Those attending the conference included senior officials from large and small innovator companies headquartered in the US and Europe, along with regulators from the US FDA and China's State FDA.

Citing examples of Teva's development partnership for biosimilar compounds with Swiss research and manufacturing company Lonza and Mylan's alliance with Indian biotech Biocon, Mr Prasad said there are a few gaps that can be filled through the partnership model.

Due to a not-so-stringent regulatory system on generic forms of biological drugs, Indian companies have been able to learn the technology early and launch those products in the market over the last six years. But costs of development are very high, and these firms need higher levels of intellectual property management and clinical development skills. Once the product is approved by the agencies and ready for launch, marketing biosimilars might require a whole new talent. Mr Prasad explained that those considerations will drive more global and Indian companies closer while competitive advantages in low-cost manpower and manufacturing infrastructure will serve as additional benefits for India and China.

According to the latest available versions of the proposed regulatory pathways for biosimilar drugs in the European Union and United States, biosimilars will not be substitutable like the existing chemistry-based generic drugs and will require significant marketing infrastructure for detailing to medical experts.

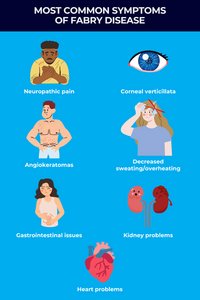

Dr Reddy's is marketing copies of G-CSF compound filgrastim in India and last year (in 2008) launched the Genentech-invented Non-Hodgkin's lymphoma drug rituximab under the brand name of Reditux. In the pipeline of Dr Reddy's are six other compounds, details of which were not shared by Mr Prasad. But the Chief Executive of the only Indian pharmaceutical company listed on the New York Stock Exchange said that copies of darbepoetin could be the next product to be launched. Darbepoetin branded Aranesp is a fast-growing Amgen drug, recommended for treatment of anaemia associated with chronic renal failure.

Though Mr Prasad did not share any specific names for the partnering, in media interviews he has hinted that his company's alliance with GlaxoSmithKline may factor into the equation. He has said in recent interviews that countries where Dr Reddy's does not have a strong marketing presence can be looked at for sharing respective expertise.

Commenting on the global generic drug industry, Mr Prasad maintained that incremental growth in generics will be limited in the next few years and a lot will have to be done on higher value products like biosimilars, complex generics and branded proprietary products before a company can put its own compound into the market.

To meet those challenges, Dr Reddy's has carved out three distinct divisions on active pharmaceutical ingredients and services, proprietary or complex products and branded and unbranded generics. “Indian companies have more scale to capture and though there is a sizeable presence from India in most countries in the generic drug market, in none of the countries have they been able to be in the top five excepting in the home turf,” Mr Prasad said while signalling that there is significant room to grow in some areas.

India itself has been seen as a growth market for several companies like GSK, Novartis, Merck, Pfizer and sanofi-aventis, but even smaller Indian companies have been able to survive at all ends of the size chain, said Mr Prasad. Yet he added that there is a strong case for consolidation in the Indian industry, maybe mostly led by multinational companies that visualize across a 10-20 year horizon.

Mr Prasad, who has been at the helm of affairs at his company and has initiated several strategic deals, said meanwhile he appreciated that Ranbaxy promoters sold off to Daiichi Sankyo at a “fabulous” value, but expressed concerns that highly valued deals like the one between sanofi-aventis and Shantha Biotech may raise expectations. He however stayed clear of linking up GSK's previously announced deal for supply of 100 branded formulations to a widely speculated equity transaction.

Hard selling a collaborative research model to discover new compounds, Mr Prasad said it may not be possible for companies of Dr Reddy's size to put a product into the market. He said his own company had some early successes, but spiralling costs resulted in restructuring of the discovery research unit.

The financial ability to develop a drug, low availability of requisite talent and the lack of an ecosystem for leads from universities is not as evolved in India as in the US So Dr Reddy's has had to combine research capabilities with its discovery services arm called Aurigene. “Multinational companies keep a tight control on the projects that they hand out and that can prove to be more educative to us in working on new products,” Mr Prasad said.

Denying any vindictiveness in US FDA's recent stringent actions with respect to Indian companies, Mr Prasad firmly said there is no political angle to the FDA moves. “It is not the level of scrutiny; it may be the level of problems that have gone up. In the past few years, Indian companies have scaled up immensely and so these come as a learning process,” he said while comparing the FDA measures with similar actions against bigger global companies.

Making a point about a healthy rivalry between Indian and Chinese companies, Mr Prasad said his company has gained significantly from competitiveness that Chinese companies bring in the manufacturing chain and also in biologics. But he admitted that in the initial years he felt “threatened” by the Chinese on the intermediates and raw materials due to “very aggressive pricing”.

Dr Reddy's revenue stood at US$1.5 billion (Euros 1 billion) for the financial year 2009 and is projected by the company to double to US$3 billion (Euros 2 billion) in about four years.

Reference:

Vikas Dandekar. Partnering Better Than Solo Play For Biosimilars, Says Dr. Reddy's CEO; Limited Growth In Generics Will Lead To Moves For Innovative Drugs. BioPharma Today. 2009 Nov 3.

0

0

Post your comment