Information recently released in May 2020 by the Patented Medicine Prices Review Board (PMPRB) provides new detail on the Canadian biologicals market for 2018, including trends and international comparisons in sales, pricing and biosimilar uptake.

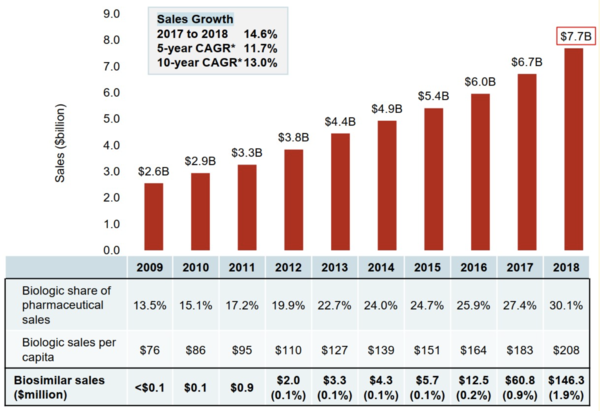

The biologicals market in Canada is significant. Sales of biological drugs in Canada have tripled over the past decade and totalled CA$7.7 billion in 2018, see Figure 1. This puts Canada among the top ranked countries in the Organisation for Economic Co-operation and Development (OECD) in terms of per capita spending.

Figure 1: Sales of biological medicines in Canada, 2009–2018

CAGR: compound annual growth rate.

Source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2018

Biosimilars are defined by Health Canada (the government department responsible for federal health policy) as biological drugs that are highly similar to a biological drug already authorized for sale and have no clinically meaningful differences in efficacy and safety to that drug. They have been available in Canada for over 10 years and in 2018 there were biosimilar medicines available to nine different biologicals.

Canada has been a leader in encouraging the use of biosimilars through switching policies, with several provinces introducing a policy to switch patients to biosimilar versions of their medications [1].

As Figure 1 shows, sales of biosimilar medicines have also increased dramatically since 2009, reaching over CA$146 million in 2019. However, the full savings from biosimilars are yet to be realized. Sales of biosimilars in 2018 amounted to less than 2% of the biologicals market in Canada.

One recent study [2] suggests that the potential cost savings from the use of three biosimilars in Canada could have been over CA$1 billion in just a two-year period. Yet only 4.2% of this potential (CA$46 million) was actually saved.

Indeed, uptake of biosimilars has been slow relative to other countries. One clear example of this is infliximab. The originator drug (Remicade) accounted for the vast majority of sales in Canada in 2018, despite a number of biosimilars being available.

Upcoming articles in this series will discuss the biologicals market in Canada in further detail, including uptake and pricing, international comparisons, and a full case study report for infliximab, the first biosimilar for which was available in 2015.

Related articles

Canada approves rituximab biosimilars Riximyo and Ruxience

Canadian firm Bausch + Lomb signs agreement on Lucentis biosimilar

Use of biosimilars for chronic inflammatory diseases in Canada

References

1. GaBI Online - Generics and Biosimilars Initiative. Ontario becomes third Canadian province to switch patients to biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2020 Jun 26]. Available from: www.gabionline.net/Biosimilars/General/Ontario-becomes-third-Canadian-province-to-switch-patients-to-biosimilars

2. GaBI Online - Generics and Biosimilars Initiative. Cost savings from the use of biosimilars in Canada [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2020 Jun 26]. Available from: www.gabionline.net/Biosimilars/Research/Cost-savings-from-the-use-of-biosimilars-in-Canada

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2020 Pro Pharma Communications International. All Rights Reserved.

Source: Government of Canada

0

0

Post your comment