The fearsome darling of the pharmaceutical industry, China, has marketers salivating over the 20%-plus annual growth, which could position the country as the world’s third-largest pharmaceutical market by 2020. Researchers are also gushing over the local clinical research organisations and the compounds they churn out. The Chinese government proclaimed that biotechnology will be a key pillar industry, and the State Council announced a two-year US$9.2 billion (Euros 6.4 billion) technology development plan earlier this year.

Domestic success

China’s domestic biopharmaceutical sales reached US$4.4 billion (Euros 3 billion) ex-factory in 2007, according to Southern Medical Economic Research Institute; ex-factory is the value out of the manufacturer as compared to other values like retail or wholesale. This figure is expected to almost double and to reach US$8 billion (Euros 5.6 billion) by 2010. While many of the international innovator drugs are on the market, including Abbott’s Humira and Herceptin from Roche/Genentech, 95% of biopharmaceuticals are either natural biologicals or recombinant biosimilars. Insulin is the single largest product, and other products in the mix include rhG-CSF (recombinant human granulocyte colony-stimulating factor), interferons, EPO, and interleukin 2. Domestic monoclonal antibodies (mAbs) are also commercialised.

Domestic biosimilars have been on the market in China for 20 years. The first recombinant human interferon 1b was launched in 1989. There is no specific process for biosimilar approval; all pharmaceuticals go through essentially the same drug registration process with the State Food and Drug Administration (SFDA), with biologicals being further reviewed by the Provincial Institute for the Control of Pharmaceutical and Biologic Products.

China could improve and enhance requirements of pharmacokinetic/pharmacodynamic (PK/PD) studies so that the design of clinical trials are more targeted, comments Mr Weihong Chang from the Center of Drug Evaluation on SFDA’s website. He points out that foreign drug regulatory agencies like the EMEA emphasise the importance of comparability research and suggest designing relatively more precise and quantitatively comparative PK/PD studies in biosimilar approvals.

On process control and validation, “The SFDA doesn't ask for much, and the analytical methods are not always the same as those used in the US, EU, or the UK,” according to Mr Robert Walsh, Managing Partner of Samsara Biopharma Consulting. “Chinese companies don't have to validate methods and can rely on the compendial methods.”

Due to this relatively low entry barrier and waves of investments, there are now over 200 biopharmas producing over 2,000 drugs. Over 20 producers of interferon and more than a dozen erythropoietin (EPO) manufacturers exist. These firms mostly target the domestic market. Even the Chinese innovators are not yet setting their sights on international markets. A company like Wuhan Hitech Biopharmaceutical, for example, who claimed the worldwide introduction of mouse nerve factor for peripheral neuropathy in 2003, still only focuses its efforts on developing new drugs for China rather than tackling other markets.

International requirements

A limited number of firms, however, are beginning to consider international markets, generally targeting countries that are still loosely regulated. 3S Bio, a major player in the EPO market, may be one of the exceptions in having European ambitions. “We have done some post-marketing safety studies, not only inside China but also in foreign countries,” says Mr Mingyu Zhang, International Business Development Manager. “The only two biotechs we found that are working towards meeting ex-China and WHO/International Conference on Harmonisation standards are Chengdu and Wuhan Institute of Biological Products.”

Additionally some contract manufacturing organisations as well as drug development companies are installing facilities that are expected to be at full US cGMP standards. “We have the facility to manufacture for others and are developing our own cell lines,” boasts Mr Joe Zhou, CEO of Genor Biopharma. “Our board has committed to doing this the right way.”

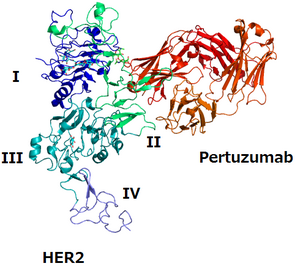

Foreign companies who may enter the Chinese market are using these manufacturers as local partners. Most recently, Shenzhen Main Luck Pharmaceuticals, an oncology subsidiary joint venture of the Chinese manufacturer and distributor Sinopharm, signed an agreement with South Korea’s Celltrion to introduce and manufacture Celltrion’s nine mAbs in China, starting with a Herceptin biosimilar.

It remains unclear whether a typical existing manufacturer would be able to meet the specifications required for international expansion without significant investment, particularly into more highly regulated European markets and US’s Amgen reviewed five Chinese and other Asian EPOs in 2008 and published product comparisons in Journal of Pharmaceutical Sciences. The results emphasise potential biochemical discrepancies resulting from different cell lines and manufacturing processes and noted that the data did not always match the information provided on the label. This, perhaps not surprisingly, supports innovators’ recommendations on extensive preclinical and clinical testing requirements.

Samsara’s Walsh suggests the key hurdle to overcome is the knowledge of regulatory affairs at the FDA and EMEA. Yes, many overseas Chinese scholars are returning, “but none that I have met so far have significant experience with regulatory affairs or overseeing a cGMP operation,” says Mr Walsh. Those who do, mostly attempt to develop their own novel products rather than working on biosimilars.

It seems that many in China do recognise this as an issue and are working to change the situation. The Peking University now offers a masters degree programme on International Pharmaceutical Engineering Management, which is “dedicated to quality management and regulatory science” and is the result of “close collaboration between Peking University and FDA”. Among the teaching faculty for this program are numerous directors of the FDA as well as process, production, quality, and business professionals in companies like Amgen, Gilead Sciences, Merck & Co and Pfizer.

It is not an easy road by any means for the current crop of Chinese biosimilar companies to tackle the bigger, more developed and lucrative markets. For those on that road, they may wish to follow a suggestion from independent regulatory consultant Dr Bruce Mackler, PhD, JD, to use less regulated markets such as China to quickly launch the product and build up its safety profile. “Products developed today have much better technology than the earlier generation novel products,” says Dr Mackler, and the biosimilar may actually be better than the original.

With the combination of government and private investor funding, experienced returnees, and a commitment to meet international regulatory standards, perhaps there will be Chinese biosimilars – or even ‘bio-betters’ – in the near future.

Source: Genetic Engineering & Biotechnology News

0

0

Post your comment