Currently, the legal pathway in the US for the approval of biosimilars is the Biologics Price Competition and Innovation Act (BPCI Act) of 2009.

The BPCI Act is part of the healthcare reform legislation, which was signed into law on 23 March 2010 by President Barack Obama. The BPCI Act establishes an abbreviated approval pathway for biological products that are demonstrated to be ‘highly similar’ (biosimilar) to, or ‘interchangeable’ with, an FDA approved biological product [1].

Despite the abbreviated pathway for biosimilars having been signed into law as part of the Affordable Care Act in 2010, FDA has yet to issue finalized practical guidance. Three years down the line FDA is still awaiting its first biosimilar application [2].

No biosimilars have as yet been approved in the US and products considered biosimilars in other regulated markets, such as Sandoz’s Omnitrope (somatropin), gained approval in the US before biosimilar regulations were created. Most recently, Teva’s Neutroval (tbo-filgrastim), known as the biosimilar Tevagrastim in the EU, received US approval under the 351(a) or Biologic License Application (BLA) route [3].

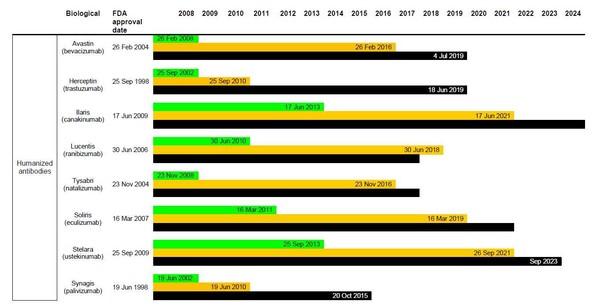

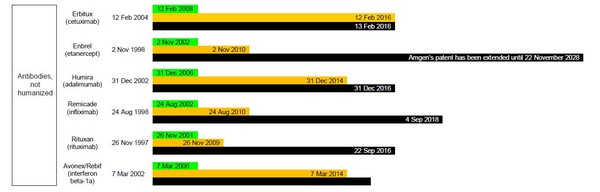

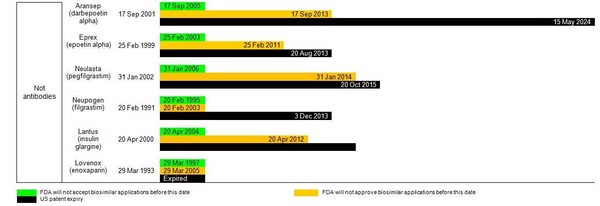

The BPCI Act allows for a pathway for marketing approval of biosimilar medicines, after a period of 12 years of exclusivity for the originator biological [4]. But how does this actually affect possible biosimilar applications in the US? Table 1 gives details on when FDA will be willing to accept biosimilar applications and from when these may be approved, according to the data exclusivity for currently approved originator biologicals.

Figure 1: Dates for FDA to accept and approve biosimilar applications in the US and relevant patent expiry dates

It is evident that even with 12 years exclusivity in the US, FDA would accept biosimilar applications for most of the biological molecules in Table 1; and many could already be approved (depending on patent protection). What is holding companies back from submitting applications for approval of biosimilars in the US is the lack of finalized guidelines from FDA.

Editor’s comment

If you would like to receive a high-resolution copy of Figure 1*, please send us an email.

*For profit organisations subjected to a fee

Related article

US$67 billion worth of biosimilar patents expiring before 2020

References

1. GaBI Online - Generics and Biosimilars Initiative. US guidelines for biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2013 May 24]. Available from: www.gabionline.net/Guidelines/US-guidelines-for-biosimilars

2. GaBI Online - Generics and Biosimilars Initiative. When will the US biosimilars pathway be used [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2013 May 24]. Available from: www.gabionline.net/Biosimilars/News/When-will-the-US-biosimilars-pathway-be-used

3. GaBI Online - Generics and Biosimilars Initiative. Teva receives FDA approval for filgrastim in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2013 May 24]. Available from: www.gabionline.net/Biosimilars/News/Teva-receives-FDA-approval-for-filgrastim-in-the-US

4. GaBI Online - Generics and Biosimilars Initiative. More debate over the exclusivity period for biological in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2013 May 24]. Available from: www.gabionline.net/Biosimilars/General/More-debate-over-the-exclusivity-period-for-biological-in-the-US

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2013 Pro Pharma Communications International. All Rights Reserved.

0

0

Post your comment