An analysis of Medicare* spending in 2019 was recently carried out by KFF, a non-profit organization that provides independent information on national health issues. The analysis found that most of the Medicare Part D** spending on drugs was on a relatively small number of drugs with only one manufacturer and without generic or biosimilar competitors [1].

In 2019, the net total Medicare Part D spending on the 3,500 drugs covered by the scheme was US$145 billion. The KFF analysis found that the 250 top-selling drugs (or 7% of total drugs) with only one manufacturer and no generic or biosimilar competition accounted for approximately US$87 billion or 60% of total drug spending in Medicare Part D. In contrast, the remaining 2,208 drugs with one manufacturer accounted for 13% of net total Part D spending in 2019, and all other covered Part D drugs (1,078) accounted for 27% of net total spending.

For the top 250 drugs the claim value was also much higher. The average net cost per claim was US$5,750, more than twice as much as the average net cost per claim for the remaining 2,208 drugs with one manufacturer (US$2,555), and more than 13 times greater than the average net cost per claim for all other covered Part D drugs (US$422) (primarily generics).

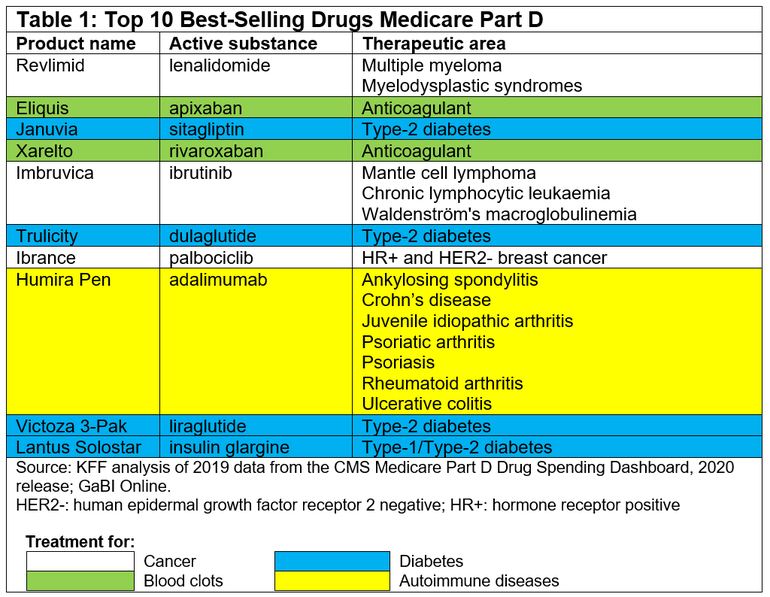

In fact, the top 10 best-selling drugs in the Medicare Part D system with no generic or biosimilar competition in 2019 accounted for 0.3% of all covered products but 16% of net total Part D spending that year. They include three drugs for cancer, four for diabetes, two anticoagulants and one rheumatoid arthritis treatment, see Table 1.

Somewhat surprisingly the top 10 best-selling drugs for Medicare Part D only include two biologicals: adalimumab and insulin glargine. However, perhaps even more surprising is the fact that the US Food and Drug Administration (FDA) has approved six adalimumab biosimilars, with the first one, Amjevita (adalimumab-atto), approved back in September 2016 [2]. While the agency has also approved three insulin glargine ‘follow-on’ products#, the first of which, Basaglar, was approved back in 2015 [2].

In the case of adalimumab, this is a clear example of an originator company delaying the launch of biosimilars in the US. AbbVie brought patent litigation against a whole host of biosimilars’ makers and eventually made agreements with these companies that would delay the launch of adalimumab biosimilars until June 2023 at the earliest [3]. These deals have led to AbbVie being accused of anti-competitive tactics to stop Humira biosimilars hitting the US market [4].

Reasons for delays in launching biosimilars include not only anti-competitive behaviours, and other market and regulatory dynamics that currently discourage market uptake of biosimilars [5], but also other issues, including the use of payment policies that disincentivize use of biosimilars and lack of understanding from providers about the efficacy, safety and interchangeability of biosimilars [6].

The analysis concluded that ‘focusing on reducing prices for a limited number of high-cost drugs could achieve significant savings’.

*Medicare is a national social insurance programme, administered by the US federal government since 1966. It provides health insurance for Americans aged 65 and older who have worked and paid into the system, as well as to younger people with disabilities.

**Medicare Part D is an optional programme to help Medicare beneficiaries pay for their prescription drugs.

#No insulin glargine products were licensed under the Public Health Service Act at the time of filing, so there was no ‘reference product’ for a proposed biosimilar product.

Related articles

A few drugs account for most of Medicare Part B spending

A small number of drugs account for most of Medicare spending

| LATIN AMERICAN FORUM – Coming soon! To further enhance the objectives of GaBI in sharing information and knowledge that ensure policies supportive of safe biosimilars use, we are pleased to announce that we will be launching a new section on GaBI Online and GaBI Journal, the ‘Latin American Forum’ (in Spanish) featuring the latest news and updates on research and developments in generic and biosimilar medicines in Latin America. Register to receive the GaBI Latin American Forum newsletter. Inform colleagues and friends of this new initiative. LATIN AMERICAN FORUM – Próximamente! Para fomentar los objetivos de GaBI sobre la difusión de información y conocimiento sobre las políticas de apoyo que garantizan el uso seguro de medicamentos biosimilares, nos complace anunciar el lanzamiento de una nueva sección en GaBI Online y GaBI Journal, el ‘Latin American Forum’ (en español), que presentará las últimas noticias y actualizaciones en investigación y desarrollo sobre medicamentos genéricos y biosimilares en Latinoamérica. Regístrese para recibir el boletín informativo GaBI Latin American Forum. Informe a colegas y amigos sobre esta nueva iniciativa.

|

References

1. Cubanski J, Neuman T. Relatively few drugs account for a large share of medicare prescription drug spending. KFF. 19 April 2021.

2. GaBI Online - Generics and Biosimilars Initiative. Biosimilars approved in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Jun 11]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-the-US

3. GaBI Online - Generics and Biosimilars Initiative. Boehringer Ingelheim finally signs licensing deal for Humira biosimilar [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Jun 11]. Available from: www.gabionline.net/Pharma-News/Boehringer-Ingelheim-finally-signs-licensing-deal-for-Humira-biosimilar

4. GaBI Online - Generics and Biosimilars Initiative. AbbVie accused of anticompetitive tactics to stop Humira biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Jun 11]. Available from: www.gabionline.net/Policies-Legislation/AbbVie-accused-of-anticompetitive-tactics-to-stop-Humira-biosimilars

5. GaBI Online - Generics and Biosimilars Initiative. The sluggish US biosimilars market [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Jun 11]. Available from: www.gabionline.net/Reports/The-sluggish-US-biosimilars-market

6. GaBI Online - Generics and Biosimilars Initiative. US policy brief identifies barriers to biosimilars uptake [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Jun 11]. Available from: www.gabionline.net/Policies-Legislation/US-policy-brief-identifies-barriers-to-biosimilars-uptake

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2021 Pro Pharma Communications International. All Rights Reserved.

0

0

Post your comment