In a presentation given by Doug Long, the expected launches and increase in uptake of biosimilars for the US market were discussed.

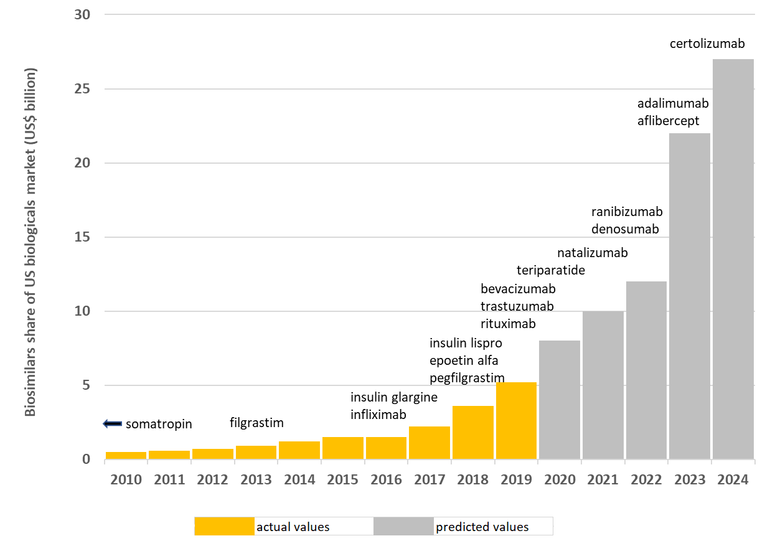

The presentation was based on the report entitled ‘Biosimilars in the US 2020–2024: Competition, savings and sustainability’ by IQVIA, it outlined how expected biosimilar launches and uptake are likely to increase overall spending on biosimilars significantly to US$16–US36 billion by 2024, see Figure 1.

In the past, the US biosimilars market has been described as ‘sluggish’ [2]. Barriers to market-entry for biosimilars include patent litigation and thickets, anti-competitive settlements and the length of time from US Food and Drug Administration (FDA) approval to market launch [3]. In fact, biosimilars currently make up only 2.3% of the US biologicals marketplace. Currently, 90% of global biosimilars sales take place in Europe, despite 60% of overall biologicals sales occurring in the US [2].

Figure 1: Expected biosimilar launches and uptake as a share of the US biologicals market

Source: Biosimilars in the US: Competition, savings and sustainability. Report by the IQVIA Institute for Human Data Science.

The landscape does, however, appear to be changing. Recent biosimilars have achieved high volume shares and IQVIA projects that these will reach more than 50% within the first two years of launch. For example, bevacizumab and trastuzumab biosimilars, which were both launched in the US in July 2019 achieved 42% and 38% market share, respectively, 12 months after first introduction. This compares to infliximab, pegfilgrastim and filgrastim biosimilars, which were launched in November 2016, July 2018 and November 2013, respectively, and only achieved 6%, 28% and 39% two years after launch, respectively.

Biosimilars launched to date account for 20% of competitive molecule volume, but this is expected to increase. The analysis by IQVIA projects savings over the next five years (2020–2024) as a result of biosimilars to exceed US$100 billion. This compares to only US$18 billion in the 2010–2018 period and US$19 billion in the 2015–2019 period.

Related articles

Biosimilars approved, launched or in development in the US

US savings from biosimilars could exceed US$100 billion

References

1. IQVIA. Biosimilars in the US 2020-2024: Competition, savings and sustainability. Report by the IQVIA Institute for Human Data Science. 29 September 2020.

2. GaBI Online - Generics and Biosimilars Initiative. The sluggish US biosimilars market [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Oct 22]. Available from: www.gabionline.net/reports/The-sluggish-US-biosimilars-market

3. GaBI Online - Generics and Biosimilars Initiative. Overcoming hurdles to biosimilars cost savings in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Oct 22]. Available from: www.gabionline.net/biosimilars/research/Overcoming-hurdles-to-biosimilars-cost-savings-in-the-US

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2021 Pro Pharma Communications International. All Rights Reserved.

0

0

Post your comment