Biosimilars are approaching a turning point in their evolution, although positive moves are being made, there is still much that has to change in order to create a global market that can sustain biosimilars [1].

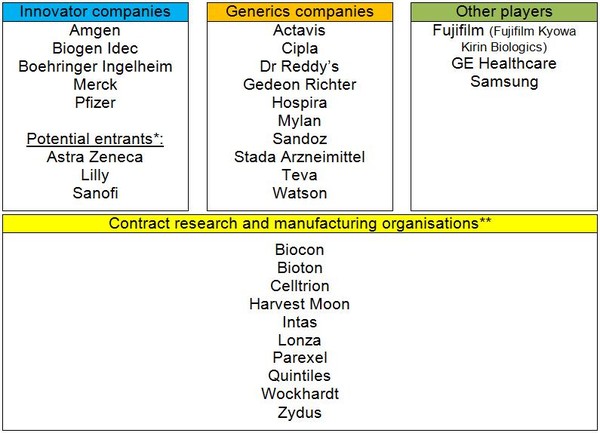

Pharmaceutical manufacturers are definitely joining the biosimilars arena, with both innovator and generics manufacturers devoting resources to biosimilars and many contract research organisations (CROs) offering services specifically tailored toward biosimilars, see Table 1.

Table 1: Key players in the biosimilars field [1]

*Based on press releases; **Providing research and manufacturing services.

This trend is supported by demand and supply drivers. Demand-side drivers include cost-saving lever for mature economics, need of broader access to medicines and sustainability in emerging economies, fragmented regulatory framework, and limited exposure (mostly Europe) of biosimilars.Biosimilars are not just proving interesting for the pharmaceutical sector, other non-pharmaceutical companies are also getting in on the act including Korean electronics giant Samsung [2] and GE Healthcare, and Japanese digital camera maker Fujifilm, making a deal in November 2011 with biotech firm Kyowa Hakko Kirin (Kyowa) [3], creating a dedicated biosimilars division called Fujifilm Kyowa Kirin Biologics.

Supply-side drivers include increasing inflow of capital and ‘branded’ capabilities, more ‘unusual’ players, increasing specialisation along the value chain, and oversupply of biologicals capacity.

Biologicals growth outlook

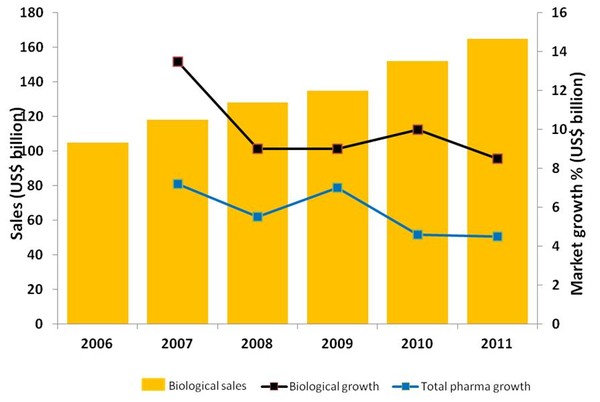

Biologicals growth in 2011 is nearly double that of total pharma growth, see Figure 1, with US (36%) being the biggest share of biologicals growth, follow by 22% EU5, 9% Japan, 8% E7 emerging economies, 3% Canada and 23% Others, it is not surprising that the global trend is for companies to move away from the highly competitive generics market towards less competitive, yet commercially attractive segments, such as speciality generics and biosimilars.

Figure 1: Global market trends 2006–2011

Source: IMS Health, MIDAS, Mat 12/2011

With worldwide growth rates for biologicals in 2011 of 8.5%, compared to 4.5% for the total pharma market, many companies are making biosimilars a priority. But what role will biosimilars have in the future of the pharmaceutical market? What factors will influence growth of the biosimilars market? What biosimilars will be made in the future? How to generate value out of biosimilars? These and other issues related to biosimilars will be discussed in the series of articles that follow.

Related articles

Positioning of biosimilars: commodity versus differentiated

Future biosimilar targets

European uptake of biosimilars

Global uptake of biosimilars

References

1. Sheppard A, Iervolino A. Biosimilars: about to leap? 10th EGA International Symposium on Biosimilar Medicines; 2012 April 19; London, UK.

2. GaBI Online - Generics and Biosimilars Initiative. Samsung makes biosimilars deal with Biogen Idec [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Jun 1]. Available from: www.gabionline.net/Biosimilars/News/Samsung-makes-biosimilars-deal-with-Biogen-Idec

3. GaBI Online - Generics and Biosimilars Initiative. Fujifilm and Kyowa in biosimilars joint venture [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Jun 1]. Available from: www.gabionline.net/Biosimilars/News/Fujifilm-and-Kyowa-launch-biosimilars-joint-venture

Permission granted to reproduce for personal and educational use only. All other reproduction, copy, retransmission or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

0

0

Post your comment