First posted: 8 October 2013

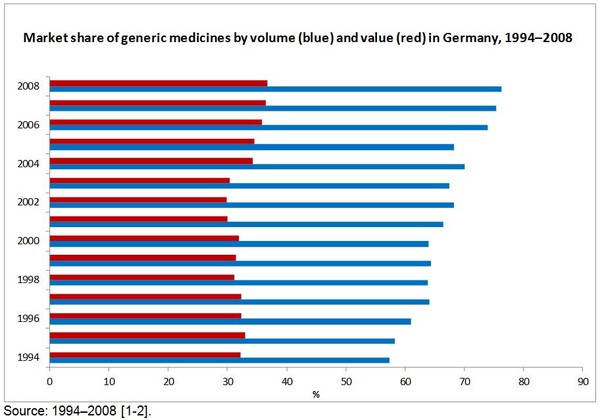

The market share of generic medicines by value has only risen slightly in Germany since 1994. Public expenditure on generic medicines rose from 32.2% of the market share by value in 1994 to 36.8% of the market share by value in 2008 [1].

The market share of generic medicines by volume (prescriptions), however, has followed a much more dramatic upward trend, increasing from 57% in 1994 to more than 76% in 2008 [2].

In Germany, pricing of medicines is officially unregulated even though the authorities influence medicine prices through the reference pricing system (RPS). The RPS covers approximately 75–80% of the market. However the notification of the manufacturer price of a medicine is obligatory [3].

The German market is very receptive to generics, which account for more than one third of the pharmacy market by value. The regulatory and reimbursement systems are ‘pro-generics’, and there is little resistance to their use from prescribers and patients [4].

Most generic medicines in Germany are marketed by a branded generic drug name [5].

International nonproprietary name (INN) prescribing for general practitioners (physicians) is indicative. However, physicians have prescription volume targets for generics and sanctions are possible when targets are not met [6].

Actual generics prescriptions as percentage of potential generics prescriptions increased from 57% in 1994 to more than 76% in 2008 [2].

Highlights of the generics market in Germany

- Market share of generic medicines by prescription is more than 76%, but only 36.8% in value [1, 3].

- Free pricing, although regulated by RPS [3, 7].

- In 2005 generic medicines were at an average level compared with prices in France, Italy, Spain and the United Kingdom [8].

- Market entry of generics benefits from a RPS that sets higher reference prices (RPs) in medicine groups with fewer generics competitors and that stimulates price competition, but still makes it possible for generics companies to earn profits [9].

- Demand for generics is driven by generics substitution by pharmacists and by physician budgets in combination with prescription targets and feedback on prescribing behaviour [9].

- Physicians can face sanctions for not meeting generics prescription volume targets [6].

- Pharmacists are financially penalised for dispensing generics and biosimilars [9].

- Patients have an incentive to buy cheaper generics as the patient co-payment is based on a percentage of the medicine price [9].

References

1. Generikapräparate, die zu Lasten der gesetzlichen Krankenversicherung verordnet wurden [Generic drugs that were prescribed at the expense of public health insurance] [homepage on the Internet]. Gesundheitsberichterstattung des bundes (gbe-bund). 2010 [cited 2013 Oct 8]. German. Available from: www.gbe-bund.de/oowa921-install/servlet/oowa/aw92/dboowasys921.xwdevkit/xwd_init?gbe.isgbetol/xs_start_neu/&p_aid=3&p_aid=79364523&nummer=356&p_sprache=D&p_indsp=-&p_aid=78195771

2. Umsatzanteil der zu Lasten der gesetzlichen Krankenversicherung verordneten Generikapräparate in % des Umsatzes aller Arzneimittel [Sales of prescriptions at the expense of public health insurance generic drugs as % of sales of all drugs] [homepage on the Internet]. Gesundheitsberichterstattung des bundes (gbe-bund). 2010 [cited 2013 Oct 8]. German. Available from: www.gbe-bund.de/oowa921-install/servlet/oowa/aw92/WS0100/_XWD_PROC?_XWD_284/3/XWD_CUBE.DRILL/_XWD_310/D.000/1

3. Österreichisches Bundesinstitut für Gesundheitswesen (ÖBIG). Surveying, assessing and analysing the pharmaceutical sector in the 25 EU Member States. 2006 Jul.

4. Germany Generics Market Intelligence Report. Espicom. August 2006.

5. Pisani J, Bonduelle Y. Opportunities and barriers in the biosimilar market: evolution or revolution for generics companies? [monograph on the internet]. Brussels, Belgium, European Generic medicines Association (EGA); 2006 [cited 2013 Oct 8].

6. Vogler S, Schmickl B. Rational use of medicines in Europe. Gesundheit Österreich GmbH/Österreichisches Bundesinstitut für Gesundheitswesen (GÖG/ÖBIG). 2010 Feb.

7. Mrazek MF. Comparative Approaches to Pharmaceutical Price Regulation in the European Union. Croat Med J. 2002;43:453-61.

8. Die Bedeutung der Generikaindustrie für die Gesundheitsversorgung in Deutschland [The importance of the generic medicines industry for the German health care system]. Accenture. 2005. German.

9. Simoens S, De Coster S. Sustaining Generic Medicines Markets in Europe. 2006 Apr. [monograph on the Internet]. Brussels, Belgium, European Generic Medicines Association (EGA) [cited 2013 Oct 8]. Available from: www.egagenerics.com/doc/simoens-report_2006-04.pdf