A bill submitted to the US Senate proposes granting up to thirteen and half years of exclusivity to biological drugs. Under the plan, the branded products would receive at least nine years of exclusivity, plus additional time depending on potential innovations made to the drug.

The proposal by late US Senator Edward Kennedy, former Chairman of the Senate Health, Education, Labor and Pensions Committee, is subject to amendments by committee members. The news follows a recent proposal from the administration of the US President, which calls for an exclusivity period of seven years for biological drugs.

Americans spend more than US$60 billion (Euros 41.57 billion) a year on biological drugs to treat cancer, rheumatoid arthritis and other illnesses, at a cost of as much as US$200,000 (Euros 138,536) per patient, Ernst & Young estimates. Generic copies of these treatments are needed to help cut costs in the overhaul of the nation’s US$2.5 trillion (Euros 1.73 trillion) healthcare system, according to President Obama.

The Senate proposal by Senator Kennedy is a placeholder that may be changed or discarded after amendments are filed by other senators. Insurers, patient groups and generic-drug makers have lobbied Congress for more than two years to let the FDA approve biosimilars.

“At a time when policy makers are looking to lower health costs so more Americans can afford care, Senator Kennedy and others want to go in the opposite direction by keeping monopoly pricing,” said Ms Katie Huffard, Executive Director of the Coalition for a Competitive Pharmaceutical Market, a Washington-based organisation of employers, insurers and consumer groups that have lobbied for generic drugs, in an e-mail.

Biosimilars might be sold 10-30% below the price of the original drugs, allowing for “substantial consumer savings,” the Federal Trade Commission said in a report of 10 June 2009. Makers of the brand-name therapies would retain as much as 90 percent of their market share, as they cut prices to stay competitive, the agency said.

Amgen, of Thousand Oaks, California, is the largest US biotechnology company, with products such as Epogen for anaemia and Neupogen to boost white blood cells after chemotherapy. Both drugs have been on the market about 20 years without generic competition in the US.

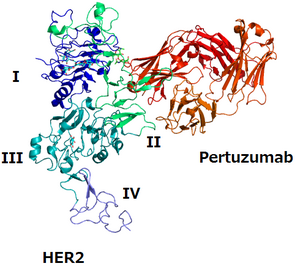

Demand for new products and the promise of higher profit margins have led makers of conventional drugs to move into biotechnology. Swiss drugmaker Roche bought partner Genentech, maker of the cancer drug Avastin, in March 2009 for US$46.8 billion (Euros 32.42 billion).

Brand-name biological drugs would get at least nine years of exclusivity aside from patent protection, plus as much as four years for new uses and six months for paediatric studies under Senator Kennedy’s plan. Drugmakers led by Amgen have sought 12–14 years of sales before biosimilars enter the market. White House officials proposed seven years in a letter of 24 June 2009 to Representative Henry Waxman, calling it a “generous compromise” with industry. “Lengthy periods of exclusivity will harm patients by diminishing innovation and unnecessarily delaying access to affordable drugs,” Ms Nancy-Ann DeParle, Director of the Office of Health Reform, and Mr Peter Orszag, Director of the Office of Management and Budget, wrote in the letter.

BIO response

The US Biotechnology Industry Organization (BIO) issued a statement saying that “This proposal would represent a stark break from the agreement struck in the Biologics Price Competition and Innovation Act of 2007, S. 1695, introduced by Senator Kennedy and Senator Mike Enzi in the 110th Congress. The Senate should return to the original agreement.”

According to BIO, the new proposal purports to establish up to 13 years of data exclusivity but, in actuality, many biologicals would receive zero years of exclusivity. The language as proposed provides nine years of base data exclusivity only to a new ‘major’ substance. Any product that is even similar to a previously approved product, in some undefined way, could get zero years of exclusivity. In addition, the proposal provides nine years of data exclusivity only to those new biologicals approved after the bill’s passage. A product approved even one day before the bill becomes law would get zero years of exclusivity, providing no protection. Such an abbreviated and uncertain period of exclusivity could lead to a dead end for many new biomedical advancement and potential cures for devastating diseases such as Alzheimer’s, cancer, multiple sclerosis, Parkinson’s, and a host of rare diseases. It also would jeopardise more than 7.5 million US jobs driven by biotechnology and the US’s leadership in biomedical innovation.

“In the end, this new proposal would provide fewer incentives for the uniquely American biotech industry than the European Union provides and it would create an incredibly complicated structure filled with uncertainty that would scare off investors and, in turn, potentially stifle efforts to pursue medical advancements and breakthroughs for patients,” BIO concluded.

Source: BIO; BIO Smartbrief; Bloomberg; FirstWord

0

0

Post your comment