Findings from an analysis carried out by KFF of Medicare* spending in 2019 found that most of the Medicare Part B** spending on drugs was on a relatively small number of drugs [1]. KFF is a non-profit organization that provides independent information on national health issues.

A few drugs account for most of Medicare Part B spending

Home/Reports

|

Posted 25/06/2021

0

Post your comment

0

Post your comment

In 2019, the net total Medicare Part B spending on the 585 drugs covered by the scheme was US$37 billion. The KFF analysis found that the 50 top-selling drugs (or 8.5% of total drugs) ranked by total spending accounted for approximately US$30 billion or 80% of total drug spending in Medicare Part B. In contrast, the remaining 485 drugs covered by Part B accounted for only 7% of total Part B drug spending in 2019.

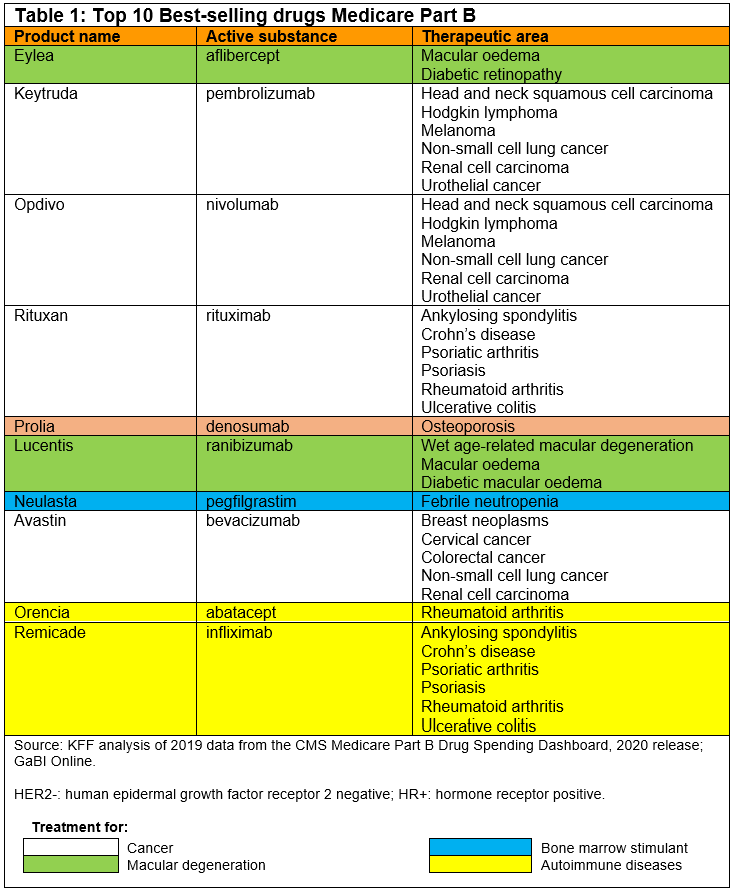

In fact, the top 10 best-selling drugs covered by the Medicare Part B system accounted for 2% of all covered products but 43% of total Part B drug spending in 2019. They include four drugs for cancer, two for macular degeneration, two for rheumatoid arthritis, one for osteoporosis and one bone marrow stimulant, see Table 1.

The top 10 best-selling drugs for Medicare Part B are all expensive biologicals. Six of these biologicals: Eylea (aflibercept), Keytruda (pembrolizumab), Lucentis (ranibizumab), Opdivo (nivolumab), Orencia (abatacept) and Prolia (denosumab), have not yet had biosimilars approved by the US Food and Drug Administration (FDA). The other four: Avastin (bevacizumab), Neulasta (pegfilgrastim), Remicade (infliximab) and Rituxan (rituximab), have all had multiple biosimilars approved by the agency [2]. However, despite their approval and launch in the country the originators are still preferred over their biosimilars. In fact, biosimilars currently make up only 2.3% of the US biologicals marketplace. Currently, 90% of global biosimilars sales take place in Europe, despite 60% of overall biologicals sales occurring in the US [3].

Reasons for the lack of uptake of biosimilars in the US include market and regulatory dynamics that currently discourage market uptake of biosimilars [3], but also other issues, including the use of payment policies that disincentivize use of biosimilars and lack of understanding from providers about the efficacy, safety and interchangeability of biosimilars [4].

The analysis concluded that ‘focusing drug price negotiation or reference pricing on a subset of drugs that account for a disproportionate share of spending would be an efficient use of administrative resources’.

*Medicare is a national social insurance programme, administered by the US federal government since 1966. It provides health insurance for Americans aged 65 and older who have worked and paid into the system, as well as to younger people with disabilities.

**Medicare Part D is an optional programme to help Medicare beneficiaries pay for their prescription drugs.

Related articles

A few drugs account for most of Medicare Part D spending

A small number of drugs account for most of Medicare spending

| LATIN AMERICAN FORUM The brand-new section the ‘Latin American Forum’ on GaBI has been launched. The objective of this new section is to provide you with all the latest news and updates on developments of generic and biosimilar medicines in Latin America in Spanish. View this week’s headline article: Un nuevo decreto modifica varios aspectos del sistema de aprobación regulatoria de biosimilares en México Browse the news in the Latin American Forum! Register to receive the GaBI Latin American Forum newsletter. Inform colleagues and friends of this new initiative. LATIN AMERICAN FORUM Se ha lanzado la nueva sección del ‘Foro Latinoamericano’ sobre GaBI. El objetivo de esta nueva sección es brindarle las últimas noticias y actualizaciones sobre desarrollos de medicamentos genéricos y biosimilares en América Latina en español. Vea el artículo principal de esta semana: Un nuevo decreto modifica varios aspectos del sistema de aprobación regulatoria de biosimilares en México Explore las noticias en el Foro Latinoamericano! Regístrese para recibir el boletín informativo GaBI Latin American Forum. Informe a colegas y amigos sobre esta nueva iniciativa. |

References

1. Cubanski J, Neuman T. Relatively few drugs account for a large share of medicare prescription drug spending. KFF. 19 April 2021.

2. GaBI Online - Generics and Biosimilars Initiative. Biosimilars approved in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Jun 25]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-the-US

3. GaBI Online - Generics and Biosimilars Initiative. The sluggish US biosimilars market [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Jun 25]. Available from: www.gabionline.net/Reports/The-sluggish-US-biosimilars-market

4. GaBI Online - Generics and Biosimilars Initiative. US policy brief identifies barriers to biosimilars uptake [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2021 Jun 25]. Available from: www.gabionline.net/Policies-Legislation/US-policy-brief-identifies-barriers-to-biosimilars-uptake

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2021 Pro Pharma Communications International. All Rights Reserved.

Source: CMS, KFF

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment