Generics giant Dr Reddy’s Laboratories (Dr Reddy’s) has been betting big on biosimilars and it seems that the risk is paying off, as the company announced record profits for the last quarter of 2011.

Dr Reddy’s looks to biosimilars for growth

Biosimilars/News

|

Posted 23/03/2012

0

Post your comment

0

Post your comment

Dr Reddy’s is looking to more complex products–particularly biosimilars–to drive future growth. In addition to the traditional, highly regulated markets, the India-based company is looking to emerging markets in South America and the Middle East to drive biosimilars sales. In its financial statement published on 3 February 2012, the company noted that its biosimilars portfolio in India grew 25% during 2011 compared with 2010.

Dr Reddy’s has been making some major investments in research and development (R & D) in biosimilars. During the period 2010–11, the company’s investments in R & D grew by 33% to over Rs crore 500, a 7% increase compared with the previous year.

Indian companies such as Dr Reddy’s, Ranbaxy, Wockhardt, Biocon, etc.; with their already low-cost manufacturing capabilities and strengths in small molecule generics, are well positioned to enter the biosimilars field. With manufacturing costs estimated at being 40% lower than those for European or US companies, they could have a big advantage [1].

Dr Reddy’s entered into the biosimilars market back in 2008 with the launch of Reditux (biosimilar rituximab), a treatment for certain lymphomas, leukaemia and rheumatoid arthritis. The company now has a total of three biosimilars on the market in India and several other countries: Cresp (biosimilar darbepoetin alfa), Grafeel (biosimilar filgrastim), and Reditux (biosimilar rituximab).

Dr Reddy’s also has a strong pipeline of biosimilars and intends to launch at least one biosimilar a year, according to its Vice Chairman and CEO, Mr GV Prasad [2]. The company’s pipeline of biosimilars includes a pegylated molecule in late-stage clinical trials, two monoclonal antibody products in late-stage development, which are scheduled to enter clinical trials, and several others in early-stage development [2].

The European biosimilars market is expected to reach almost US$4 billion by 2017, with a compound annual growth rate of a staggering 56.7%, according to researchers at Frost & Sullivan [3], while the Indian biosimilars market was worth about US$200 million in 2008 and is expected to reach about US$580 million in 2012. So the future looks bright for biosimilars and it is no wonder that generics manufacturers are moving in this direction.

Related articles

Highs and lows for biosimilars during 2009/2010

References

1. GaBI Online - Generics and Biosimilars Initiative. Biotech growth and biosimilar opportunities in India [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 23]. Available from: www.gabionline.net/Biosimilars/General/Biotech-growth-and-biosimilar-opportunities-in-India

2. GaBI Online - Generics and Biosimilars Initiative. Dr Reddy’s launches biosimilar Aranesp [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 23]. Available from: www.gabionline.net/Biosimilars/News/Dr-Reddy-s-launches-biosimilar-Aranesp

3. GaBI Online - Generics and Biosimilars Initiative. European biosimilars market to reach almost US$4 billion by 2017 [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 23]. Available from: www.gabionline.net/Biosimilars/News/European-biosimilars-market-to-reach-almost-US-4-billion-by-2017

Source: Dr Reddy’s, The Hindu

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

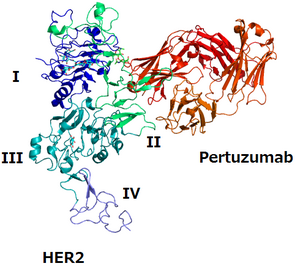

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

Biosimilars/News Posted 07/01/2026

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

Biosimilars/News Posted 05/12/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment