According to researchers at Frost & Sullivan, the European market for biosimilars will experience strong growth in the coming years due to patent expiries of blockbuster biologicals between 2010 and 2017. Cost containment strategies being implemented by governments and healthcare service providers are also given credit for shifting sales towards cheaper biosimilars.

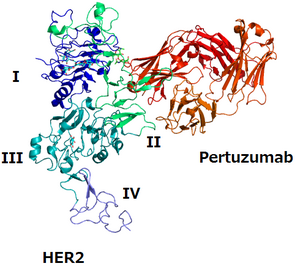

The analysis, which included the existing biosimilars segments (erythropoietin, granulocyte colony-stimulating factors and human growth hormones) and emerging biosimilars segments (monoclonal antibodies, insulin and interferon alpha and beta), predicted that the European biosimilars market would reach almost US$4 billion by 2017 compared to just US$172 million in 2010, with a compound annual growth rate of a staggering 56.7%. The increase is mainly attributed to patent expiries, but price reduction strategies were also given some credit.

It seems that, although lucrative, the biosimilars market may be only for the ‘big fish’. High manufacturing costs may constitute a major barrier to market entry. Frost & Sullivan analyst Mr Srinivas Sashidhar cautions that while ‘price reduction strategies will ensure increased adoption among physicians and patients alike ... the need for considerable financial outlays will hinder the entry of small biotech firms in particular’. However, there is a light at the end of the tunnel, with collaborations and licensing agreements between companies becoming an increasingly popular solution.

Some notable biosimilars deals include those of biotech giant Amgen and US generics manufacturer Watson Pharmaceuticals [1] and Icelandic generics manufacturer Actavis and Polish biotech Bioton [2]. Even non-pharma have been getting in on the act, with Korean electronics giant Samsung announcing that it had entered into a biosimilars joint venture deal with US biotechnology company Biogen Idec in December 2011 [3].

Collaborations between pharmaceutical companies and specialty biotech firms with technical expertise will be important in order to gain access to sales and marketing capabilities to promote greater uptake of biosimilars. This can only be achieved by effective sales communication to the scientific community, coupled with continuous promotional activities as well as close and constant interaction with physicians and pharmacists.

Related articles

Generics market to experience strong growth in 2010–2017

Top developments in biosimilars during 2011

References

1. GaBI Online - Generics and Biosimilars Initiative. Amgen finally jumps on biosimilars bandwagon [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 9]. Available from: www.gabionline.net/Biosimilars/News/Amgen-finally-jumps-on-biosimilars-bandwagon

2. GaBI Online - Generics and Biosimilars Initiative. Samsung makes biosimilars deal with Biogen [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 9]. Available from: www.gabionline.net/Biosimilars/News/Samsung-makes-biosimilars-deal-with-Biogen-Idec

3. GaBI Online - Generics and Biosimilars Initiative. Actavis and Bioton form joint venture for insulin [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 9]. Available from: www.gabionline.net/Pharma-News/Actavis-and-Bioton-form-joint-venture-for-insulin

0

0

Post your comment