The domestic biotechnology industry in India has seen rapid growth during 2010 and India is poised to attain a position of leadership in the biosimilars market according to reports from Ernst & Young India and Frost and Sullivan.

Biotech growth and biosimilar opportunities in India

Biosimilars/General

|

Posted 02/09/2011

0

Post your comment

0

Post your comment

India’s biotechnology sector is the third largest in the Asia Pacific region, after Australia and China. The industry is now worth more than US$4 billion, growing from around US$3 billion in 2009, and tripling in size in the last five years alone [1].

Despite this rapid growth, relatively little funding is available for innovative biotech R & D. Of the US$3 billion invested in Indian health care and life sciences over the last decade, only US$90 million has gone towards innovative biotechnology. The Indian government, however, is taking a major role in supporting the industry by giving grants and loans to biotechnology start-up companies as well as for ‘breakthrough research’ along with government-led initiatives and construction of biotechnology parks.

Biosimilar opportunities

There are more than 40 biologicals marketed in India, of which 25 are biosimilars. Acceptance of biosimilars in India is high and substitution is automatic [2].

The Indian biosimilars market has also seen robust growth and the country is poised to attain a position of leadership in the global biosimilars field. With the introduction of insulin and erythropoietin biosimilars, India has proved its capability to be a major contributor to this market. With biosimilar manufacturers such as Wockhardt, Biocon, Dr Reddy’s, Intas Biopharmaceuticals, and many emerging participants, India could be getting ready to dominate the global biosimilars market.

Indian companies, with their already existing low-cost manufacturing capabilities and strengths in small-molecule generics, are well positioned to enter the biosimilars field. It is estimated that 48 biologicals — with sales of US$73 billion — will lose patent protection in the next decade, making biosimilars a lucrative market to enter.

Cost is a major advantage for the Indian biosimilar industry. The manufacture and development of a biosimilar molecule in India requires an estimated investment of US$10 to 20 million, compared to US$50 to 100 million in developed countries. With cost reductions of around 40% this makes India a very attractive destination for biosimilar manufacture [3]. However, government plans to introduce process patents for biosimilars may impact on this profitability [2].

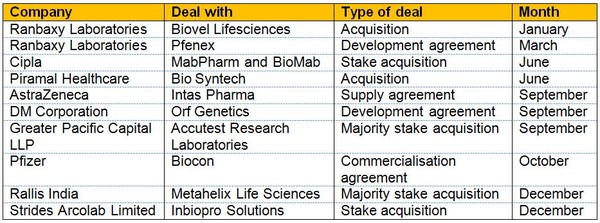

Building on a surge of biosimilar product launches in 2009, the industry experienced over 40 deals in 2010. These included Biocon’s commercialisation agreement with Pfizer [4] and Cipla’s acquisition of a large stake in MabPharm and BioMab [5], see Table 1.

Table 1: Indian biosimilar deals in 2010

Source: Ernst and Young

With increased financial assistance and opportunities, the biotechnology industry in India will continue to make progress. While, with its cost advantages and strengths in small-molecule generics, India is sure to be a major player in the biosimilars field for the foreseeable future.

Related articles

India’s top pharma company strengthens ties with South Africa

The hurdles to biosimilars in Europe

References

1. Ernst and Young. Beyond borders. Global biotechnology report 2011. 25th Ed. 2011.

2. Ariyanchira S. The opportunity for India in the global biosimilars market. 21 June 2010.

3. Frost and Sullivan. Strategic analysis of Indian biosimilar market. 10 May 2011.

4. GaBI Online - Generics and Biosimilars Initiative. Cipla enters the biosimilars market [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 September 02]. Available from: www.gabionline.net/Biosimilars/News/Cipla-enters-the-biosimilars-market

5. GaBI Online - Generics and Biosimilars Initiative. Pfizer and Biocon make biosimilar insulin deal [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 September 02]. Available from: www.gabionline.net/Biosimilars/News/Pfizer-and-India-based-Biocon-make-biosimilar-insulin-deal

Source: Ernst & Young, Frost & Sullivan

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

News

EMA recommends approval for teriparatide biosimilar Zandoriah

FDA approves third interchangeable ranibizumab biosimilar Nufymco

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Stelara biosimilars enter US market with 85% discount in 2025

IFPMA publishes position on pharmacy-mediated substitution for biosimilars

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Biosimilars/General Posted 30/07/2025

Chinese biosimilars go global: growth, partnerships, and challenges

Biosimilars/General Posted 30/04/2025

IFPMA publishes position on pharmacy-mediated substitution for biosimilars

Biosimilars/General Posted 21/03/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment