The top 10 selling originator biological drugs accounted for over half of all biological sales in Canada in 2018, new data reveal.

The cost of biologicals in Canada

Home/Reports

|

Posted 10/07/2020

0

Post your comment

0

Post your comment

Canada has a significant market for biological drugs. Canadians spent an average of CA$208 per person on biological drugs in 2018 and sales of biologicals represent almost a third of all pharmaceutical sales in the country [1]. Analysis by the Patented Medicine Prices Review Board (PMRPB) in Canada released in a recent May 2020 report has also revealed the cost of biological drugs to public and private payers in the country.

The analysis focused on plans representing roughly one third of total annual spending on prescription drugs in Canada; and showed that the top 10 selling biologicals accounted for 55% of biological sales in Canada in 2018, see Table 1. Sales of these drugs also accounted for 17% of the total pharmaceutical market in Canada in 2018.

| Table 1: Market share for the 10 top-selling originator biologicals in Canada, 2018 | |||

| Originator biological (medicine) | Sales (CA$ million) | Share of biological sales | Share of pharmaceutical sales |

| Remicade (infliximab) | $1,081 | 14.1% | 4.2% |

| Humira (adalimumab) | $800 | 10.4% | 3.1% |

| Eylea (aflibercept) | $493 | 6.4% | 1.9% |

| Stelara (ustekinumab) | $338 | 4.4% | 1.3% |

| Lucentis (ranibizumab) | $317 | 4.1% | 1.2% |

| Enbrel (etanercept) | $291 | 3.8% | 1.1% |

| Lantus (insulin glargine) | $273 | 3.5% | 1.1% |

| Rituxan (rituximab) | $266 | 3.5% | 1.0% |

| Keytruda (pembrolizumab) | $202 | 2.6% | 0.8% |

| Herceptin (trastuzumab) | $186 | 2.4% | 0.7% |

| Total | $5,534 | 55.2% | 16.6% |

| Source: IQVIA MIDAS Database, prescription retail and hospital markets, 2018. | |||

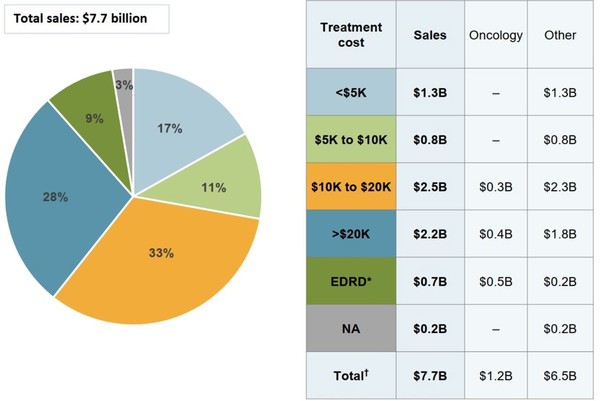

The PMRPB also reports that the highest cost biological medicines account for the majority of spending on biologicals in Canada. Biologicals with average yearly costs in excess of CA$10,000 comprised 70% of biological sales in 2018, see Figure 1, the accompanying table gives the sales of medicines in each range of treatment costs and the distribution of sales by oncology and non-oncology medicines.

Figure 1: Biological medicine sales distribution by treatment cost (CA$), Canada, 2018

Note: Annual treatment costs based on average annual per beneficiary costs for public and private plans.

EDRD: expensive drugs for rare diseases; NA: no treatment cost available.

Sources: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information; IQVIA Private Pay Direct Drug Plan Database, 2018; IQVIA MIDAS Database, prescription retail and hospital markets, 2018.

Expensive drugs for rare diseases (EDRD), see Figure 1, are defined as medicines having an orphan designation from the US Food and Drug Administration (FDA) or the European Medicines Agency (EMA) and an annual treatment cost above CA$100,000 (or CA$7,500 per 28-day course of treatment for oncology medicines).

Biological medicines with treatment costs below CA$10,000 represented 28% of sales in 2018. The data also reveal that there were no oncology medications with treatment costs below CA$10,000 in 2018.

Overall, spending on biologicals represented over 27% of drug costs for public and private plans in 2018 in Canada, where the retail market for biologicals is almost equally split between public and private payers.

Despite this, biologicals only represented 1.5% and 1.9% of claims made by public and private plans, respectively. This is partly due to their high cost and infrequent delivery, the PMRPB suggest.

The report notes that plan designs, reimbursement policies and reporting practices (as well as demographic and disease profiles) vary across Canadian jurisdictions, which somewhat limits the comparability of the results.

Related article

Biosimilar infliximab uptake in Canada

Low levels of biosimilar uptake in Canada

Trends in biological drugs in Canada

Reference

1. GaBI Online - Generics and Biosimilars Initiative. Analysis of biological sales for OECD countries [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2020 Jul 10]. Available from: www.gabionline.net/Reports/Analysis-of-biological-sales-for-OECD-countries

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2020 Pro Pharma Communications International. All Rights Reserved.

Source: Government of Canada

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment