Use of biosimilars in Europe varies widely between countries and therapy areas, according to a report published by IMS Health in October 2014.

Biosimilars use in Europe varies widely

Home/Reports

|

Posted 14/11/2014

0

Post your comment

0

Post your comment

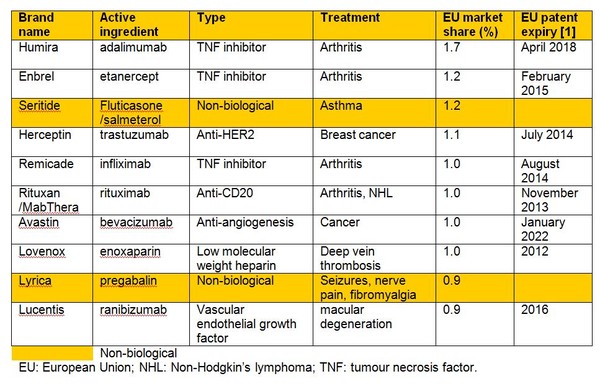

Biologicals currently account for 27% of pharmaceutical sales in Europe, with growth of 5.5% versus total pharmaceutical market growth of 1.9% in sales value between 2012 and 2013. In fact, of the top 10 best-selling drugs in Europe, only two are non-biologicals, see Table 1.

Table 1: Top 10 best-selling drugs in Europe 2013

The patents on all of these biological blockbusters will have expired in Europe by 2022. For just these eight molecules, this will open up around US$63 billion in sales to competition from biosimilars [2].

Biosimilars have been approved in the European Union since 2006 in the classes of erythropoietin (EPO), human growth hormone (HGH), granulocyte colony-stimulating factor (G-CSF) and anti-tumour necrosis factor (anti-TNF). Despite this fact, biosimilar uptake varies widely between countries and therapy areas.

The IMS Health report found that biosimilar penetration for HGH ranged from a low of 2% of the available market in Norway to a high of 99% in Poland. EPO biosimilar penetration ranged from 1% in Croatia to 62% in Bulgaria. G-CSF biosimilar penetration was the lowest in Belgium with a 2% share of the available market and highest, with nearly 100% share of the accessible market, in Croatia, Czech Republic, Hungary, and Romania. Similarly, large differences in biosimilar penetration were observed between therapy areas within countries, for example, in Sweden biosimilar HGH has an 18% share of the volume while biosimilar G-CSF has an 81% share.

The report concludes that differences in the use of biosimilars are not just explained by epidemiology and disease factors, but reflect local adoption of treatment practices and guidelines influenced by funding decisions and payer actions. This highlights the need for physician education and introduction of national policies to increase the use of biosimilars.

Related articles

Germany wants to increase biosimilars penetration

UK biosimilars uptake lower than in some other EU countries

References

1. GaBI Online - Generics and Biosimilars Initiative. US$67 billion worth of biosimilar patents expiring before 2020 [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2014 Nov 14]. Available from: www.gabionline.net/Biosimilars/General/US-67-billion-worth-of-biosimilar-patents-expiring-before-2020

2. GaBI Online - Generics and Biosimilars Initiative. Top 8 blockbuster biologicals 2013 [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2014 Nov 14]. Available from: www.gabionline.net/Biosimilars/General/Top-8-blockbuster-biologicals-2013

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2014 Pro PharmaCommunications International. All Rights Reserved.

Source: IMS Health

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment