By 2020 biological products with sales of around US$23 billion in the EU and US$29 billion in the US are expected to be exposed to biosimilar competition [1].

US$54 billion worth of biosimilar patents expiring before 2020

Biosimilars/Research

|

Posted 30/09/2011

0

Post your comment

0

Post your comment

Obstacles with biosimilar entry timing are caused by the following facts:

- There is no centralised listing of biological patents (like the Orange Book) and company analysis is kept confidential

- Platform patents protect broad groups of products, e.g. humanised antibodies, which are not product specific

- Each product has formulation patents which are difficult to assess

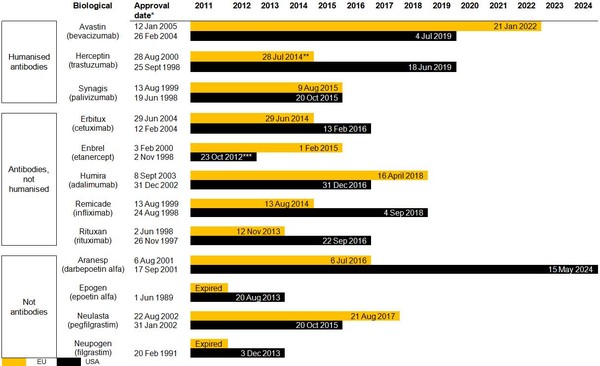

Estimated patent expiry dates for 12 major biological molecules are shown in Figure 1.

Figure 1: Expiry dates for patents on the 12 major biologicals

* EU provides 10 years of data exclusivity, US BPCI Act provides 12 years exclusivity

** In the UK. Other major EU markets follow on 28 August 2015.

*** Aqueous formulation patent runs until 2023, but dry powder biosimilar possible.

Source: Bernstein Research

For a high-resolution copy of Figure 1 please contact editorial@gabionline.net

Europe

European ‘composition of matter’ patents on Herceptin (trastuzumab), Remicaid (infliximab) and Rituxan (rituximab) will expire between November 2013 and July 2014, opening the way for biosimilar players.

Antibody biosimilars are expected to be introduced in Europe in the fourth quarter of 2013.

USA

The US market will open in the fourth quarter of 2013, with antibody biosimilars launching potentially in the fourth quarter of 2015 or early 2016.

Biosimilars for Epogen and Procrit (epoetin alfa) and Neupogen (filgrastim) are expected to enter the US market upon expiry of the ‘composition of matter’ patent in late 2013 as would ‘biobetters’ to Aranesp (darbepoetin alfa) and Neulesta (pegfilgrastim).

Other antibody products, such as Erbitux (cetuximab), Humira (adalimumab), Rituxan (rituximab), Synagis (palivizumab), will lose their ‘composition of matter’ patents and/or exclusivity protection in the fourth quarter of 2015 and early 2016. However, Roche’s Cabilly patent (platform patent) is expected to protect Rituxan until the end of 2018. After 2018, it is suspected that Roche will negotiate or barter the Cabilly patent rights to antibody markets it does not participate in.

This is a serious opportunity for biosimilar manufacturers. Almost US$54 billion of biological sales will be open to competition from biosimilars by 2010. No wonder that both generics manufacturers and Big Pharma, as well as biotech companies, are also vying for a piece of this lucrative pie [2].

Related articles

The US biosimilars law may prove a barrier to entry for biosimilars

Biosimilars: barriers to entry and profitability in the EU and US

References

1. Gal R. Biosimilars: Reviewing US law and US/EU patents; bottom up model suggests 12 products and $7-$8B market by 2020. Bernstein Research. 26 May 2011.

2. GaBI Online - Generics and Biosimilars Initiative. Everybody jumping on the biosimilars bandwagon [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 September 30]. Available from: www.gabionline.net/Biosimilars/News/Everybody-jumping-on-the-biosimilars-bandwagon

News

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

What is the future for the US biosimilar interchangeability designation

Biosimilars/Research Posted 05/06/2025

Biosimilar clinical efficacy studies: are they still necessary?

Biosimilars/Research Posted 27/05/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment