When and where to launch a new biosimilar to ensure that its uptake is the most effective throughout Europe is an issue that affects all pharmaceutical companies working on biosimilars [1].

Timing of the launch of biosimilars in Europe

Biosimilars/Research

|

Posted 12/08/2011

0

Post your comment

0

Post your comment

In Europe, there is a mutual recognition process for the regulatory process leading to the licensing of biosimilars for sale in all countries within the EU. However, the acceptance of biosimilars differs significantly between different countries [2].

The main obstacle to overcome in order to commercialise a biosimilar is the restrictions placed on pharmacy substitution of an originator drug with a biosimilar— either for legal or clinical reasons. Therefore, successful commercialisation will depend on winning the acceptance of clinicians to interchange their prescribing of originator products for biosimilars.

This can mean that countries with low acceptance, and therefore low adoption of biosimilars, such as Italy, can wait much longer for a biosimilar, compared to the first countries where the biosimilar was launched.

Pricing and reimbursement policies may also influence companies in their choice of countries to initially launch the biosimilar. Reference pricing can also influence the choice of country, with countries with low pricing policies being left till last or avoided so as not to lower prices in other countries using reference pricing.

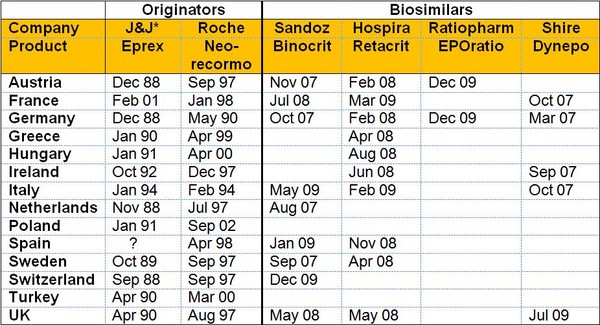

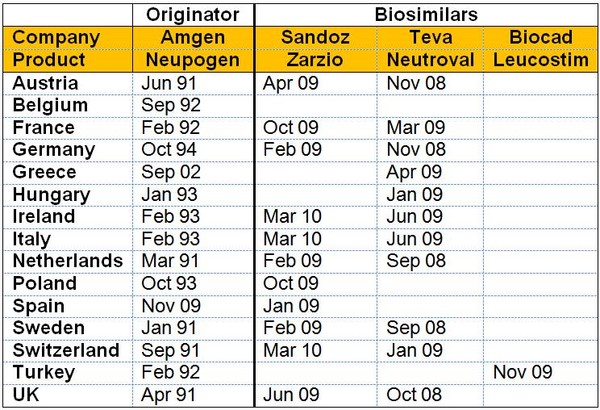

The varying launch dates for erythropoietin (EPO) biosimilars and granulocyte colony-stimulating factor (G-CSF) biosimilars compared to the originator molecules are shown in Figures 1 and 2, respectively.

In the case of EPO it can clearly be seen that Italy, with low acceptance of biosimilars, had a launch date for the biosimilar Binocrit of almost two years after the initial launch in the high acceptance countries of Austria, Germany, Sweden, and The Netherlands, see Figure 1. This delay is even worse in the case of the originator Eprex, where the delay for Italy is five years. This could mean that patients in Italy are not getting sufficient access to what are, in many cases, life-saving medicines.

With G-CSF, Italian patients had to wait almost one year longer for access to the biosimilars Enoxaparin and Neutroval compared to patients in Sweden or the UK, see Figure 2. Once again this situation was worse with the originator, where the product was launched almost two years after the first launch in the high acceptance countries of The Netherlands and the UK. Greece fares even worse, though gaining access to the originator only 11 years after the initial launch.

Figure 1: Timing of launch by country for EPO

*J&J: Johnson and Johnson

Source: Bernstein Research

Figure 2: Timing of launch by country for G-CSF

Source: Bernstein Research

The penetration and adoption of EPO and G-CSF biosimilars was delayed due to some of the following reasons:

-

organisational issues

- hiring and training marketing staff

- learning the markets -

conservatism due to new medical concept

- what are biosimilars

- overcome initial concerns -

poorly conceived payment schemes

- provide financial incentive to prescribe biosimilars -

complexity of markets

- two EPO presentations (Sandoz lacking subcutaneous)

- public and private market segments -

pricing

- Amgen chose to match biosimilar price

- price relatively low in some countries.

Related articles

How cheap will biosimilars need to be

Challenges ahead for biosimilar development

Questions over US biosimilars pathway in light of Teva’s BLA

EGA meeting London 2011: biosimilars competitiveness in the EU

US biosimilars pathway unlikely to be used

References

1. Gal R. Biosimilar development is progressing, but bigger challenges are ahead. 9th EGA International Symposium on Biosimilar Medicines; 2011 Apr 14; London, UK.

2. GaBI Online - Generics and Biosimilars Initiative. The market for biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 August 12]. Available from: www.gabionline.net/Biosimilars/Research/The-market-for-biosimilars

News

FDA approves third interchangeable ranibizumab biosimilar Nufymco

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

What is the future for the US biosimilar interchangeability designation

Biosimilars/Research Posted 05/06/2025

Biosimilar clinical efficacy studies: are they still necessary?

Biosimilars/Research Posted 27/05/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment