IMS Health predicts a slowing down of the growth in annual spending on medicines, with generics being one of the main contributing factors for this reduction.

Biosimilars and the pharmaceutical industry

Biosimilars/Research

|

Posted 09/09/2011

0

Post your comment

0

Post your comment

The global pharmaceutical market grew to US$808 billion in 2009, at a compound annual growth rate of 9.3% between 1999 and 2009. Year-on-year growth in the global pharmaceutical market decreased to 4.6% in 2009, largely as a result of cost containment in the US and major European markets and the impact of several blockbuster patent expiries in 2008 and 2009 [1].

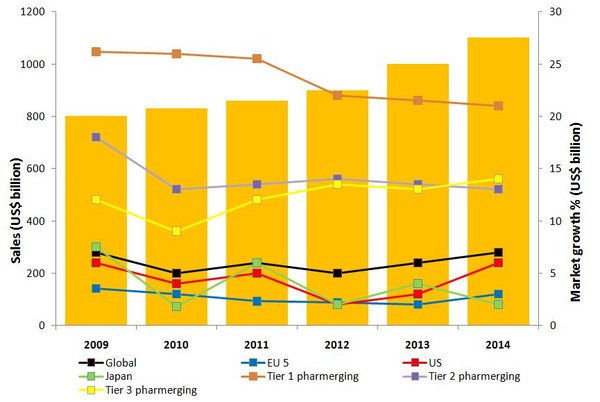

Despite this slow down, global spending on medicines is expected to reach US$1 trillion by 2020, with a compound annual growth rate of 2–5% for mature markets between 2009 and 2014, see Figure 1 [2].

Figure 1: Global pharmaceutical sales 2009–2014

Source: IMS Health

EU 5: France, Germany, Italy, Spain and UK; Tier 1 pharmerging: China; Tier 2 pharmerging: Brazil, India, Russia; Tier 3 pharmerging: Argentina, Egypt, Indonesia, Mexico, Pakistan, Poland, Romania, South Africa, Thailand, Turkey, Ukraine, Venezuela, Vietnam.

The EU major five France, Germany, Italy, Spain and the UK, together accounted for over 60% of all European pharmaceutical sales in 2009 [1].

Pfizer had the greatest number of blockbuster products in 2009 with 14, which includes five inherited through the acquisition of Wyeth [1].

The pharmaceutical industry is increasingly focusing on the high-growth pharmerging markets. Many of these countries are benefiting from greater government spending on healthcare and broader public and private healthcare funding – which is driving greater access to, and demand for, medicines.

Pharmerging markets present an obvious opportunity, with compound annual growth rates of 10–25%, making these lucrative markets to gain a foothold in, but what role will biosimilars have in the future of the pharmaceutical market? Indeed is there a future for biosimilars or will biobetters become the future? This and other issues related to biosimilars will be discussed in the series of three articles that follow.

Related articles

The market for global and European biosimilars

Generics and biosimilars to drive down drug spending

References

1. Urch Publishing. Pharmaceutical Market Trends, 2010 – 2014. Key market forecasts & growth opportunities (4th Edition). October 2010.

2. Sheppard A. Biological/Biotechnological and Biosimilars market: the global outlook. 9th EGA International Symposium on Biosimilar Medicines; 2011 Apr 14; London, UK.

News

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

What is the future for the US biosimilar interchangeability designation

Biosimilars/Research Posted 05/06/2025

Biosimilar clinical efficacy studies: are they still necessary?

Biosimilars/Research Posted 27/05/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment