At a ‘strategy and outlook’ seminar for investors held on 6 September 2011, sanofi-aventis (sanofi) CEO Mr Christopher A Viehbacher commented on the group’s outlook. The group has undergone radical changes since 2008, when it was faced with losing several blockbuster drugs over a relatively short time period, the so-called ‘patent cliff’. The main action sanofi took was to buy biotech company Genzyme and thus gain access to the biosimilars, rare diseases and multiple sclerosis markets. However, other actions not so interesting to the media have also played a great part in the company’s repositioning.

Sanofi announces new long-term objectives

Biosimilars/News

|

Posted 23/09/2011

0

Post your comment

0

Post your comment

Biosimilars are not the only strategy

So, biosimilar Lantus (insulin glargine [rDNA origin] injection) was not high on the agenda, whereas the change from ‘brand management to brand-based solutions’ for Lantus, the company’s most important drug, was. The insulin market is increasingly about pens and peripherals: the SoloSTAR pen which accounts for 40% of new Lantus prescriptions in the US, the BGStar glucose monitoring devices, and a forthcoming integrated device for Lantus dosing with a patient-driven titration algorithm. Nevertheless, Lilly has two basal biosimilar insulins, including a copy of Lantus, starting phase III trials this year.

Consistent and sustainable growth

Genzyme was in fact one of 23 acquisitions, as the company cut back its own R & D activities. Diabetes Solutions is one of six ‘growth platforms’, which include emerging markets and animal health. In 2011, sales of key generic products are expected to decline to about Euros 3 billion vs Euros 7.6 billion in 2008. In parallel, consolidated sales generated by growth platforms and Genzyme should exceed Euros 22 billion in 2011 compared to Euros 11.8 billion in 2008. The last significant headwind remains the impact on profit contribution from Plavix (clopidogrel) and Avapro (irbesartan) in the US following the end of exclusivity in May 2012 and March 2012, respectively. Sanofi estimates that this will reduce net business income by around Euros 1.4 billion in 2012. By 2013 sanofi expects a similar income to 2008.

By 2015 the growth platforms and Genzyme will together contribute a predicted 80% of the group’s income. Sanofi has indeed undergone an impressive transformation over the last two and a half years.

Source: sanofi-aventis

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

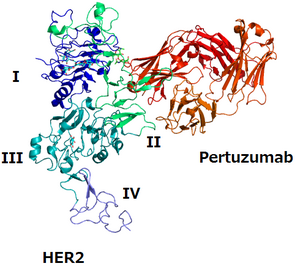

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

Biosimilars/News Posted 07/01/2026

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

Biosimilars/News Posted 05/12/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment