“I think it is a good strategy for a large company like Pfizer that wants to be a player in generics”, Ronny Gal, a Sanford C Bernstein Analyst in New York said. “I would be surprised if they weren’t considering biogenerics”.

Pfizer’s biosimilars strategy

Biosimilars/News

|

Posted 22/01/2010

0

Post your comment

0

Post your comment

The market for biological copies will grow during the next five years as patents expire on medicines whose annual sales total US$15.3 billion, including Roche’s cancer drug MabThera, sold as Rituxan in the US with Biogen Idec, and Eli Lilly’s diabetes treatment Humalog, according to IMS. That market is already drawing rival pharmaceutical companies. Merck & Co, based in Whitehouse Station, New Jersey, announced plans in 2008 to start a unit to copy biotech medicines and said it would sell at least six biogeneric drugs by 2017. Biosimilars are attractive to drugmakers because they are priced higher than traditional generic pills. Making a copy of a biological medicine costs less than inventing one because there is less testing and development involved.

Copies of biotech drugs have been sold in Europe since 2006, and companies in that market are investing in technology to bolster their capabilities in anticipation of new US rules. Teva of Petah Tikva, Israel, Novartis’ Sandoz division of Basel, Switzerland, and Hospira of Lake Forest, Illinois, have won approval in Europe for biosimilars. These products are not considered interchangeable with brand-name medicines in Europe unlike with generic pharmaceuticals. Novartis, which sells versions of Epogen and Pfizer’s growth hormone Genotropin through its Sandoz unit, committed as much as US$263 million to Momenta Pharmaceuticals of Cambridge, Massachusetts, to copy Lovenox. Teva, which sells in Europe a copy of Amgen’s Neupogen, used to treat infections in patients undergoing chemotherapy, is seeking approval of the drug in the US as a new medicine because there is not a procedure yet to approve biosimilars. Teva is the world’s biggest maker of generic drugs.

Through the Wyeth purchase in October 2008, Pfizer gained a larger biologicals business than its own. Before that, Pfizer had been buying smaller biotech companies, such as CovX Research LLC for its antibody technology and Rinat Neuroscience Corporation for its experimental Alzheimer’s drug.

David Simmons, Head of Pfizer’s Established Products Business Unit, said he is on the hunt for deals and partnerships with companies that have biologicals technology. “If I see an opportunity in the near term with an external partner, I would be pursuing it pretty rapidly using my business unit’s own resources”, David Simmons, Head of Pfizer’s Established Products Business Unit said.

Pfizer has its own biologicals, such as the arthritis treatment Enbrel, which it got from its acquisition of Wyeth, and the human growth hormone Genotropin, that may face competition once legislation is enacted. “Eventually you are going to see a lot more companies looking into biosimilars”, said James Greenwood, CEO of the Washington-based Biotechnology Industry Organization (BIO) in an interview on 3 December 2009. “It will be the biggest generic companies; it will be Big Pharma and Big Biotech”. (see also Pfizer and the US Biosimilars Pathway and Pfizer plans to launch biosimilars of Top 10–15 biologicals)

References:

Pfizer plans to launch versions of biotech blockbuster drugs. BIO SmartBrief. 2009 December 9

Shannon Pettypiece. Pfizer Seeks Boost From Copying Biotechnology Drugs (Update4). Bloomberg. 2009 December 9.

Source: BIO SmartBrief; Bloomberg

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

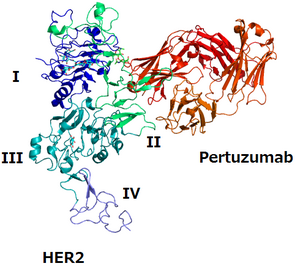

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

Biosimilars/News Posted 07/01/2026

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

Biosimilars/News Posted 05/12/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment