It may take about four to five years for a biogeneric drug to hit the US market, even though industry experts are optimistic about the passage of pending healthcare reform legislation there by the end of 2009.

It may take four to five years before the first US biosimilar is a fact

Biosimilars/News

|

Posted 01/12/2009

0

Post your comment

0

Post your comment

James Greenwood, President and CEO of the Biotechnology Industry Organization (BIO), said that the four to five years timeframe takes into account the possibility that the US FDA may require about a year to promulgate regulation in this area and possibly also issue guidances on each class of drugs.

“Then you have to assume that it's going to take some time for generic companies to develop their products and they will have to do some clinical testing, probably immunogenicity studies or maybe some small trials or even large ones, depending on what the FDA says. Then there's the FDA approval process time, which could be about a year,” Mr Greenwood said at the sidelines of Bioinvest 2009 on 5 November, organised by the Association of Biotechnology-led Enterprises, in Mumbai, India.

US healthcare reform measures recently passed in the US House energy and commerce and US Senate health committees each provide 12 years of marketing exclusivity for novel biologicals. However, the Generic Pharmaceutical Association, a US generics group, has asked President Barack Obama to urge congressional leaders to strike biosimilars language from the pending healthcare legislation unless the 12-year exclusivity term is cut.

Mr Greenwood also suggested that generic companies may be exaggerating the cost savings that may accrue with the entry of biosimilars on the market. “It [cost savings] won't be like it is for small molecules, where there are many more players/potential manufacturers and prices can drop precipitously by as much as 90% almost overnight,” he said.

With fewer companies able to make biologicals, at least in the first few years or so, Mr Greenwood believes that the market penetration of biogenerics could be about 25%, with prices going down by about 35%, assuming that substitution is not required by a payer and is left to the physician and patient to decide on. The management consultancy Accenture had recently pegged potential cost-savings with biosimilars at 20%–30%.

Mr Greenwood also expects more large companies to straddle the biosimilars segment alongside the innovation business, just as is being witnessed in the generics segment. “There are already indications that companies like Pfizer will get into the biosimilars market and it’s natural to expect that if you're an Amgen, Genentech, etc, as you already have capacity, skills, know-how to manufacture biologicals,” he added.

Reference:

Anju Ghangurde. Four to five years for the first biogeneric in the US? Scrip News. 2009 Nov 9.

Source: Scrip News

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

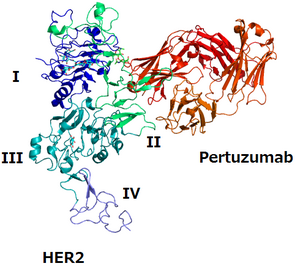

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

Biosimilars/News Posted 07/01/2026

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

Biosimilars/News Posted 05/12/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment