Since the Indian government announced that it wants to make almost US$70 million (Euros 49.7 million) in funding available for the development of biosimilar medicines, Indian generics firms adapt their strategies and plan to go abroad. The proposed US$68 million (Euros 48.3 million) in funding just announced by India's Department of Biotechnology would be offered through the Biotech Industry Partnership Programme, with soft loans being available for biosimilar development at an interest rate of about 2%.

Indian firms may well take large slice of global biosimilars pie

Biosimilars/News

|

Posted 30/07/2009

0

Post your comment

0

Post your comment

Many Indian generic companies already have expertise in developing and marketing versions of top-selling biotech drugs in India. The key players are Ranbaxy, Wockhardt, Dr Reddy's Laboratories and Biocon. This is a high-growth area for India, where some domestic firms are already manufacturing products like insulin, G-CSF, monoclonal antibodies, interferon-alfa and erythropoietin, helped by their extensive experience in the manufacture of fermentation-based pharmaceuticals.

Dr MK Bhan, Secretary of India's Department of Biotechnology, said that biosimilars offered a great opportunity for India in key global markets. They do indeed. So far, Indian firms have concentrated on the home biosimilars market and other less regulated countries, but now they are extending their reach. Some companies are targeting the EU, which already has a biosimilars regulatory pathway in place. They, and others, are also now looking to the even more lucrative US market where a biosimilars pathway is now taking shape.

According to some estimates, the EU and US together offer a potential US$16 billion (Euros 11.38 billion) in biosimilar sales within the next two years, while more than 20 biologicals worth some US$60 billion (Euros 42.68 billion) are due to come off patent in the US by the end of 2010. Indian companies look well placed to take a large slice of the global pie. Some are already developing their biosimilars in line with EU requirements.

Biocon, based in Bangalore, is understood to be interested in filing for an insulin product in Europe. It has also ploughed a lot of money into products such as biosimilar granulocyte colony-stimulating factor (G-CSF), human growth hormone, streptokinase and reteplase.

Ranbaxy has a global development and marketing agreement with Hyderabad-based Zenotech Laboratories for the G-CSF, filgrastim, for chemotherapy-induced neutropenia. Under the deal, Ranbaxy plans to target global markets, beginning with the EU. It has other biosimilars in the pipeline too.

Dr Reddy's already sells G-CSF in India and some countries in Asia and Africa, and is conducting biosimilar development work on several more branded products that are facing imminent patent expiry, with a view to marketing its own versions in the more regulated markets.

Wockhardt, meanwhile, estimates that by 2010 “biogenerics will constitute a significant 10% of the global US$100 billion (Euros 71.11 billion) biopharmaceuticals business,” and claims to be well prepared to tap this opportunity. It says it has set up “comprehensive concept-to-market capabilities” for biosimilars for international markets, and plans to introduce one product per year. As well as the more developed markets, it has designs on Russia and countries in Africa, South America and Central and Southeast Asia.

Biosimilar companies in India have a number of advantages, including a large number of FDA-approved manufacturing plants and increasingly high rates of compliance with good clinical practice standards. This will help them in their efforts to get products approved abroad.

While the EU is already in their sights, the US is now proving even more attractive. In March 2009, three new draft US biosimilars bills were introduced. One was the Promoting Innovation and Access to Life-Saving Medicine Act proposed by Representative Henry Waxman, which would offer a clear regulatory pathway for the approval of biosimilars, together with a five-year exclusivity period for novel biological, although that will be fiercely debated – the biotech industry is holding out for 12-14 years.

The Waxman bill was described by Biocon Chairman Kiran Mazumdar-Shaw as “a landmark announcement”. Mr Mazumdar-Shaw told the Indian Financial Express newspaper that “all our programmes can now be developed along the new guidelines that the US will announce for biogenerics.” Other compatriot companies will doubtless be thinking along the same lines.

The Indian firms will all no doubt be pleased too by their government’s funding announcement, which promises to give a further boost to an already rapidly growing sector. The biotechnology department has a good record in supporting industrial projects, spending around US$200 million (Euros 142 million) a year to develop biotechnology initiatives.

So, as more biosimilars are approved in the EU and a US pathway begins to take shape, the major biotech companies will have a fight on their hands in the form of competition not only from established generic firms such as Ratiopharm, Sandoz and Teva, but also from the new players from the Indian subcontinent. And with pressure on drug prices and healthcare spending still firmly on the agenda of governments around the world, the fight can only get tougher.

Source: Scrip

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

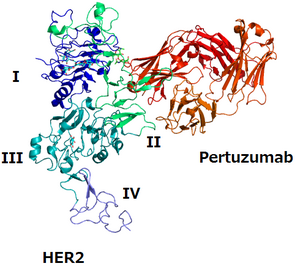

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

Biosimilars/News Posted 07/01/2026

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

Biosimilars/News Posted 05/12/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment