US President Barack Obama’s plan for economic growth and deficit reduction, announced on 19 September 2011, recommends a series of healthcare reforms. The proposals include higher drug rebates for low-income patients, banning pay-to-delay deals between generics and originator companies and reducing biologicals exclusivity from 12 to seven years. The proposals aim to save US$320 billion in healthcare spending over 10 years.

Generics and biosimilars affected by Obama’s deficit plans

Biosimilars/News

|

Posted 23/09/2011

0

Post your comment

0

Post your comment

Drugmaker cuts

Brand-name drugmakers would be asked to give a 23% discount or rebate to the government for low-income patients who get a subsidy to pay for drugs. Generic drugmakers would have to give a 13% rebate. The drug rebates are expected to save the government US$135 billion over 10 years.

This is not good news for generics manufacturers who may already be operating on low margins in the highly competitive US generics market.

Banning pay-to-delay deals

President Obama is also proposing a ban on the somewhat controversial pay-to-delay deals.

The Federal Trade Commission (FTC) has for years opposed pay-to-delay patent litigation settlements, in which a brand-name drug manufacturer compensates its generics competitor to delay entering the market and offering patients a lower-cost alternative.

According to the FTC these deals delay the introduction of lower-cost medicines by an average of 17 months [1] and cost consumers and taxpayers US$3.5 billion a year in higher drug prices.

The Generic Pharmaceutical Association (GPhA), however, has reacted with concern over the proposal to ban patent settlements. The GPhA disagrees that these deals delay generic entry arguing that ‘patent settlements have never prevented competition beyond a patent’s expiration, and in many cases have resulted in making lower-cost generics available months and even years before patents have expired. In fact, of the 23 new generic drug launches expected in 2011, settlements made 17 of these possible where the generic will launch prior to a patent’s expiration’ [1].

Biologicals exclusivity

The plan intends to reduce biologicals market exclusivity from the 12 years foreseen in the BPCI Act to seven years, as previously proposed by President Obama in his 2012 budget proposal.

This, if it goes ahead, would be great news for biosimilar products which could be launched five years earlier.

Related articles

More debate over ‘pay-to-delay’ legislation in the US

Battle over ‘pay-for-delay’ deals continues

US bill to curb generic ‘pay-for-delay’ deals

References

1. GaBI Online - Generics and Biosimilars Initiative. Pay-to-delay deals up by 60% in US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 September 23]. Available from: www.gabionline.net/Pharma-News/Pay-to-delay-deals-up-by-60-in-US

2. GaBI Online - Generics and Biosimilars Initiative. Authorised generics implicated in pay-to-delay deals [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 September 23]. Available from: www.gabionline.net/Pharma-News/Authorised-generics-implicated-in-pay-to-delay-deals

Source: The White House

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

EMA recommends approval for teriparatide biosimilar Zandoriah

FDA approves third interchangeable ranibizumab biosimilar Nufymco

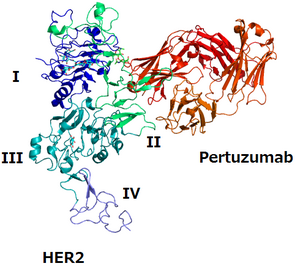

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves third interchangeable ranibizumab biosimilar Nufymco

Biosimilars/News Posted 09/02/2026

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment