Though the threat of biosimilars is a hot topic in the US biotech market, their introduction in Europe may reveal that their effects will be limited.

Current European biosimilars market may suggest US threat to biotech will be limited

Biosimilars/News

|

Posted 14/09/2009

0

Post your comment

0

Post your comment

Biosimilars, which are as close to a generic version as possible for complex biological drugs, have not gained traction in Europe because of limited cost savings and worries that they are not exact copies. The struggling for biosimilars uptake in the more cost-conscious European market hints that lucrative US biological drugs may be able to defend their turf.

"Clearly the impact of biosimilars in Europe has not been very dramatic in terms of market share and price," Credit Suisse analyst Mr Michael Aberman said.

There is no regulatory pathway for generic biotech drugs, produced through biological processes, but that could change by year-end with a structure similar to that in Europe.

Generic pharmaceuticals – made with chemicals – must show that they have the same active ingredient as the brand-name version. But biological molecules are often thousands of times bigger, making it extremely hard to make a carbon copy – hence the name, biosimilar. These drugs, sold as distinct brands, cost more to produce than traditional generic pills, which can cost just pennies.

In the US, most biologicals have years of patent protection remaining, but European patent expirations have led to biosimilars of Amgen’s anaemia treatment Epogen, and Neupogen, which wards off infections in chemotherapy patients. Amgen does not actually sell Epogen in Europe, because of a licensing agreement with Johnson & Johnson (J&J), which sells a similar product called Eprex. But European market share of Amgen's Aranesp, a longer lasting version of Epogen, has remained steady as Amgen responded to biosimilar competition by lowering prices in some countries.

In May 2009, Amgen CEO Mr Kevin Sharer projected that biologicals should maintain 30–50% of their cash flows in the face of biosimilar competition, a rate that is drastically different from the small-molecule market.

Some European biosimilars have been selling for 18 months, notes Barclays Capital biotech analyst Mr Jim Birchenough, but they have only managed to grab 5–10% of the European market on average. That is a stark comparison to traditional generics that often grab 80% of branded sales in a matter of months.

The low biosimilar adoption rate stems from physician concern about imperfect copies causing problems in a patient, and the related cost savings not being worth that risk.

Earlier in the decade, J&J learned a hard lesson when a slight change in the manufacturing process for Eprex seemed to result in severe immune system reactions in hundreds of patients.

Biological production difficulties have been demonstrated by industry leader Genzyme, which faces shortages of its top-selling drugs because of facility contamination and delays in mass production of Pompe-disease treatment Myozyme due to slight differences from smaller batches.

To be sure, the European market could shift as time passes and biosimilars become more common. Some believe they will gain traction in the US, simply because cultural differences make it more acceptable to use generics. "There is historically a lot less generic penetration in Europe," Natixis Bleichroeder analyst Corey Davis said.

Even if biosimilars are successful in the US, Mr Birchenough points out that Epogen and Neupogen are "relatively simple" compared to many biological drugs.

In order to develop copycat versions of more complex drugs, generic companies will have to make significant investments and may need to conduct large clinical trials to convince regulators of their similarity. Biosimilar makers, which will likely include prominent biotech and pharmaceutical names, may find that it makes more sense to make slightly better versions of the drugs in order to ensure a better return on that investment. "I just don't see the value proposition of doing full clinical development work in order to grab 5% of the market," Mr Birchenough said.

Source: Dow Jones Newswires

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

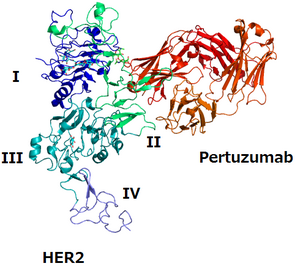

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

Biosimilars/News Posted 07/01/2026

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

Biosimilars/News Posted 05/12/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment