In the recently published article ‘Bracing for Biosimilars’ by Kuyler Doyle, Tony Lanzone and Fahti Khosrow-Shahi of management consultancy firm Campbell Alliance, some insight is given into what commercial and reimbursement decision makers for biotechnology companies should be doing to prepare for the arrival of biosimilars.

Campbell Alliance: how biotech should prepare for biosimilars

Biosimilars/News

|

Posted 01/02/2010

0

Post your comment

0

Post your comment

According to the authors, the earliest biologicals on the market are those under the most immediate threat. Companies marketing those products must systematically identify actions they can take to brace for the increase of follow-on biologic competitors. Although some markets may be difficult for biosimilars to penetrate initially, updates to brand strategies will require thorough assessments of the competitive landscape, in-depth scenario planning, and new revenue forecasts that incorporate the emerging threats.

Lifecycle management

Traditional lifecycle management tools can be employed in response to follow-on biologics, including pricing, product improvements, and authorised biosimilars. Biotechnology companies will need to explore pricing and contracting strategies that could minimise loss of market share while maximising sales. New technologies to improve manufacturing and cut costs can be explored to help with pricing, although pursuing new processes will not always be worth the investment of equipment and bioequivalence studies.

Organisations can also work to improve or expand the product line, either through second-generation products with enhanced formulation or by development of a novel delivery system. One potential roadblock to this strategy is the threat of ‘biobetter’ follow-on biologics that may also pursue a competitive advantage. Alternatively, a company may also help create an authorised biosimilar by licensing their technology to the manufacturer, thereby maintaining revenue that will help offset some of the lost market share. ‘Reverse payment settlements’ to follow-on biologic companies that delay market entry may not be a viable option, as their legality remains questionable and the US House of Representatives included language (Rush amendment) in its health-reform bill to ban the practice.

Payer communication

Payer engagement will be critical to prepare for market entry of follow-on biologics. Product strategies related to the payer-specific value proposition and contracting will need to be revisited. The value proposition will need to be updated to fully inform payers of potential differences between biosimilars and their branded products. Cost effectiveness of the branded product will need to be highlighted, including details regarding proven health outcome benefits of the drug. Prices for the branded product will need to be justified with data demonstrating proven results. Rebate contracting for use of the branded product will also need to be carefully examined. Key payer accounts with broad market reach and influence for the indication should be approached for contracting in order to help maintain market share.

Physician and patient education

In order to make informed treatment decisions, healthcare professionals will be searching for means to gain a thorough understanding of the issues surrounding use of biosimilars rather than branded biologicals. Medical Affairs teams will have the opportunity to educate physicians and key opinion leaders on the underlying scientific differences with follow-on biologics that could potentially alter safety and efficacy. Traditional marketing campaigns can also be launched detailing the many years that the drug has effectively treated many patients. These programmes should focus on the differentiation of the branded product from the biosimilar.

Intellectual property

For products in early stage development, the threat of biosimilars is long term. However, biotechnology companies should be planning strategically now through use of intellectual property protection. Not only should patents be pursued for composition of matter, method of use, formulation, and methods of manufacture, but trade secrets regarding manufacturing procedures that could potentially help differentiate the innovator product from a biosimilar should also be carefully guarded.

Reference:

Kuyler Doyle, Tony Lanzone and Fahti Khosrow-Shahi of Campbell Alliance. Bracing for Biosimilars.

Source: Bracing for Biosimilars

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

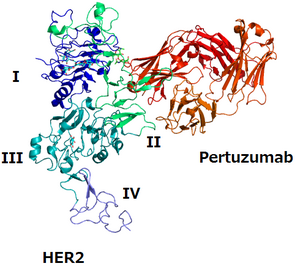

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

Biosimilars/News Posted 07/01/2026

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

Biosimilars/News Posted 05/12/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment