Strong growth prospects for the global biosimilars space over the next decade are bringing together the world's third-largest US-based generic drugmaker Mylan and Biocon, India's second-largest biotech company.

Biocon and Mylan join forces in biosimilars

Biosimilars/News

|

Posted 04/09/2009

0

Post your comment

0

Post your comment

They announced a worldwide, exclusive agreement to develop, manufacture and commercialise biosimilar drugs. Mylan will get exclusive marketing rights for the treatments in Australia, Canada, the EU, Japan, New Zealand and the US through a ‘profit-sharing agreement’ with Biocon. Both companies will sell the drugs in other markets worldwide. Financial terms were not disclosed.

“Through this partnership we hope to deliver high-quality, affordable biosimilar antibodies and biologicals, thereby addressing a critical need to lower spiralling healthcare costs in both the developed and emerging economies,” Ms Kiran Mazumdar-Shaw, Biocon’s Managing Director, said in the statement.

“Biosimilars, especially monoclonal antibodies, are expected to become the next great bolus of growth in the generic pharmaceutical industry, and through this alliance, Mylan and Biocon have covered all four corners of what any organisation would want or need to have secured to offer a highly competitive and distinct biosimilars product portfolio with tremendous growth potential for the coming decade.”

The generics segment in the pharmaceutical industry, which is currently based almost entirely on chemically synthesized drugs, is poised for a changing paradigm. The pressure to lower healthcare costs is galvanising governmental efforts globally to facilitate the entry of biosimilar or protein-derived drugs.

An estimated US$25 billion (Euros 17.8 billion) worth of biologicals will have lost patent protection by 2016, creating a significant market opportunity for protein therapeutics like insulin and its analogues, erythropoietin, human growth hormone, monoclonal antibodies and many others. The complexity and costs involved in developing biosimilars are expected to see only a few players being able to gain entry into the highly regulated markets of Europe and the US.

Biosimilars in the emerging markets are expected to grow from the current estimate of US$1.5 billion (Euros 1 billion) at a projected rate of over 20% per annum over the next five years. Biocon is well positioned to capitalise on these opportunities through its early investments in research, development and manufacturing of high-quality protein therapeutics, including both novel biologicals and biosimilars.

Combining this with Mylan’s regulatory and commercialisation capabilities in Europe and the US creates a cost-effective model to address a large, emerging opportunity for biosimilars. Especially since the Obama administration announced that brand-name biologicals should face competition from these cheaper copies in the US after seven years.

Source: Biocon, Bloomberg, FirstWord, Mylan, Windhover

Research

Reaching ESG goals in pharmaceutical development

What is the future for the US biosimilar interchangeability designation

General

Samsung Bioepis wins Pyzchiva case; Regeneron patent rulings threaten foreign biosimilars

Chinese biosimilars go global: growth, partnerships, and challenges

Most viewed articles

The best selling biotechnology drugs of 2008: the next biosimilars targets

Global biosimilars guideline development – EGA’s perspective

Related content

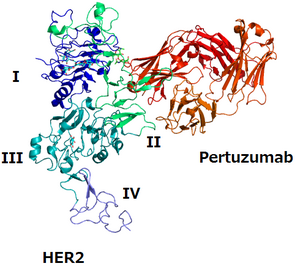

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

Biosimilars/News Posted 27/01/2026

EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

Biosimilars/News Posted 16/01/2026

FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

Biosimilars/News Posted 07/01/2026

FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

Biosimilars/News Posted 05/12/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment