Both the US House and Senate healthcare bills include language that would allow US regulators to set up a method for approving copies of biotechnology drugs. Under the proposals, biologicals would get 12 years of market exclusivity before copies could enter the market. Both US chambers must agree on final language in their overhaul measures.

- Home

-

Generics

News

- FDA approves generic teriparatide and levetiracetam

- US generics launch and approval for Dr Reddy’s and Lupin

- Five Chinese companies join UN’s MPP for Covid-19 medicines

- South Korean companies to make generic Bridion and COVID-19 drugs

Research

- Japan’s drug shortage crisis: challenges and policy solutions

- Saudi FDA drug approvals and GMP inspections: trend analysis

- Generic medications in the Lebanese community: understanding and public perception

- Community pharmacists’ understanding of generic and biosimilar drugs: Lebanon case study

-

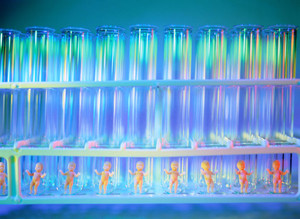

Biosimilars

News

- FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

- EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

- FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

- FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

- MORE EDITORIAL SECTIONS

- Search

0

0

Post your comment