Generics giant Dr Reddy’s Laboratories (Dr Reddy’s) has been betting big on biosimilars and it seems that the risk is paying off, as the company announced record profits for the last quarter of 2011.

Dr Reddy’s is looking to more complex products–particularly biosimilars–to drive future growth. In addition to the traditional, highly regulated markets, the India-based company is looking to emerging markets in South America and the Middle East to drive biosimilars sales. In its financial statement published on 3 February 2012, the company noted that its biosimilars portfolio in India grew 25% during 2011 compared with 2010.

Dr Reddy’s has been making some major investments in research and development (R & D) in biosimilars. During the period 2010–11, the company’s investments in R & D grew by 33% to over Rs crore 500, a 7% increase compared with the previous year.

Indian companies such as Dr Reddy’s, Ranbaxy, Wockhardt, Biocon, etc.; with their already low-cost manufacturing capabilities and strengths in small molecule generics, are well positioned to enter the biosimilars field. With manufacturing costs estimated at being 40% lower than those for European or US companies, they could have a big advantage [1].

Dr Reddy’s entered into the biosimilars market back in 2008 with the launch of Reditux (biosimilar rituximab), a treatment for certain lymphomas, leukaemia and rheumatoid arthritis. The company now has a total of three biosimilars on the market in India and several other countries: Cresp (biosimilar darbepoetin alfa), Grafeel (biosimilar filgrastim), and Reditux (biosimilar rituximab).

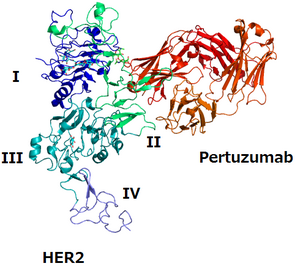

Dr Reddy’s also has a strong pipeline of biosimilars and intends to launch at least one biosimilar a year, according to its Vice Chairman and CEO, Mr GV Prasad [2]. The company’s pipeline of biosimilars includes a pegylated molecule in late-stage clinical trials, two monoclonal antibody products in late-stage development, which are scheduled to enter clinical trials, and several others in early-stage development [2].

The European biosimilars market is expected to reach almost US$4 billion by 2017, with a compound annual growth rate of a staggering 56.7%, according to researchers at Frost & Sullivan [3], while the Indian biosimilars market was worth about US$200 million in 2008 and is expected to reach about US$580 million in 2012. So the future looks bright for biosimilars and it is no wonder that generics manufacturers are moving in this direction.

Related articles

Highs and lows for biosimilars during 2009/2010

References

1. GaBI Online - Generics and Biosimilars Initiative. Biotech growth and biosimilar opportunities in India [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 23]. Available from: www.gabionline.net/Biosimilars/General/Biotech-growth-and-biosimilar-opportunities-in-India

2. GaBI Online - Generics and Biosimilars Initiative. Dr Reddy’s launches biosimilar Aranesp [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 23]. Available from: www.gabionline.net/Biosimilars/News/Dr-Reddy-s-launches-biosimilar-Aranesp

3. GaBI Online - Generics and Biosimilars Initiative. European biosimilars market to reach almost US$4 billion by 2017 [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Mar 23]. Available from: www.gabionline.net/Biosimilars/News/European-biosimilars-market-to-reach-almost-US-4-billion-by-2017

Source: Dr Reddy’s, The Hindu

0

0

Post your comment