Fifty-five per cent of biosimilar opportunities from loss of exclusivity come from just 10% (13) biologicals, which are concentrated in the oncology space, according to a report released by data analysis firm IQVIA [1].

Preparing for future biosimilar opportunities

Home/Reports

|

Posted 08/04/2022

0

Post your comment

0

Post your comment

The report, which was carried out at the request of the European Commission, found that this provides large opportunities to make savings and increase access to previously high-cost cancer medications.

Previous IQVIA reports have shown the size of the opportunity available to biosimilar competition in the future peaks around 2027–2028 at €8 billion when PD-1 inhibitors, such as Keytruda (pembrolizumab) and Opdivo (nivolumab), lose their exclusivity [2].

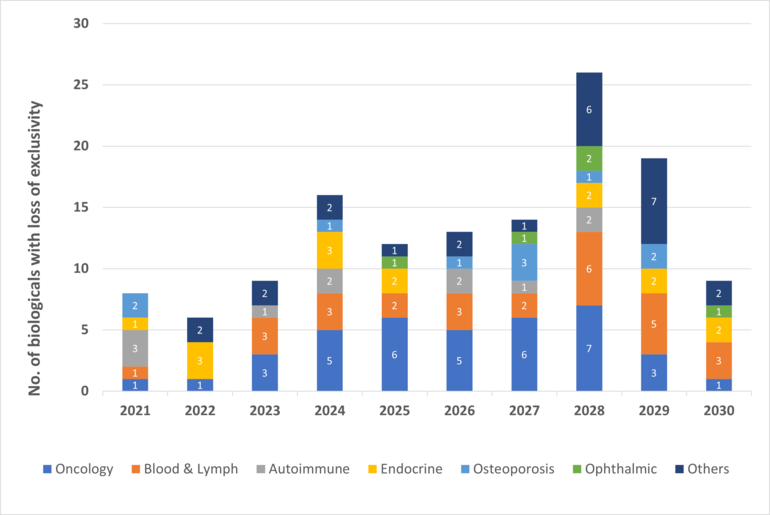

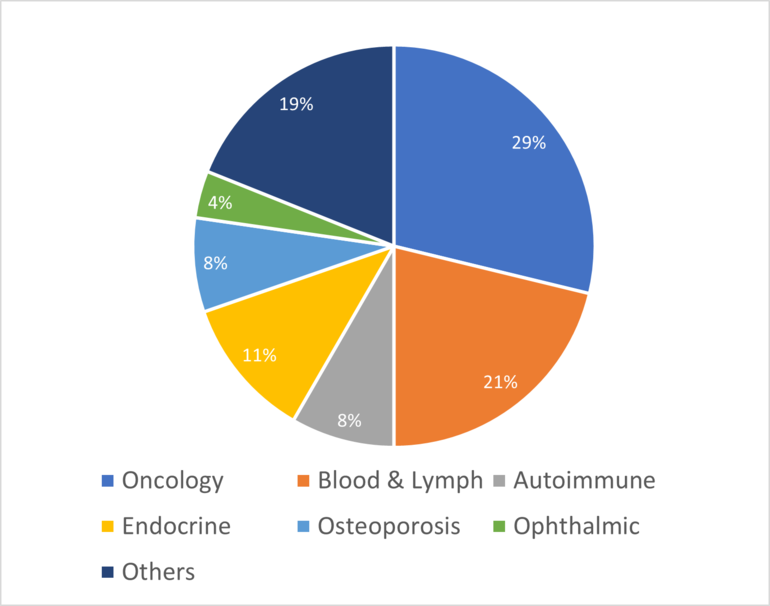

Over the next 10 years, the majority of biologicals losing their exclusivity will be oncology biologicals (29%), followed by biologicals to treat blood and lymphatic conditions (21%), see Figures 1 and 2. Ensuring that physicians working in these areas are aware of biosimilars will be critical to success. However, more importantly, having a sustainable purchasing policy in place that can manage the biosimilars that enter the markets will be critical.

Figure 1: Biologicals expected to lose exclusivity by therapy area

Figure 2: Composition of biologicals expected to lose exclusivity by therapy area

How to manage the fact that most new biosimilars will be in just two areas raises problems. Firstly, how to manage biosimilar introductions in other areas and ensure that biosimilar makers are incentivised to take these smaller opportunities. Secondly, the ‘major molecules’ and the ‘large molecules’ are only 20% of all biologicals losing exclusivity but are twice as many as Europe has experienced since the introduction of biosimilars in 2006 (18 total in 2021).

Conflict of interest

The authors of the report [1] did not provide any conflict-of-interest statement.

Editor’s comment

Readers interested to learn more about loss of exclusivity and biologicals are invited to visit www.gabi-journal.net to view the following manuscript published in GaBI Journal:

The European framework for intellectual property rights for biological medicines

GaBI Journal is indexed in Embase, Scopus, Emerging Sources Citation Index and more.

Readers interested in contributing a research or perspective paper to GaBI Journal – an independent, peer reviewed academic journal – please send us your submission here.

Related articles

How biosimilar competition in Europe is changing

Developing access to biologicals remains challenging

Savings from biosimilars reached an all-time high in 2021

Impact of the COVID-19 pandemic on biologicals

Impact of biosimilar competition in Europe in 2021

| LATIN AMERICAN FORUM The new section of the ‘Latin American Forum’ on GaBI has been launched. The objective of this new section is to provide you with all the latest news and updates on developments of generic and biosimilar medicines in Latin America in Spanish. View this week’s headline article: Biocomparables aprobados en México Browse the news in the Latin American Forum! Register to receive the GaBI Latin American Forum newsletter. Inform colleagues and friends of this new initiative. LATIN AMERICAN FORUM Se ha lanzado la nueva sección del ‘Foro Latinoamericano’ sobre GaBI. El objetivo de esta nueva sección es brindarle las últimas noticias y actualizaciones sobre desarrollos de medicamentos genéricos y biosimilares en América Latina en español. Vea el artículo principal de esta semana: Biocomparables aprobados en México !Explore las noticias en el Foro Latinoamericano! Regístrese para recibir el boletín informativo GaBI Foro Latinoamericano. Informe a colegas y amigos sobre esta nueva iniciativa. |

References

1. Troein P, Newton M, Scott K, et al. The impact of biosimilar competition in Europe: December 2021. IQVIA.

2. Derbyshire M. Patent expiry dates for biologicals: 2018 update. Generics and Biosimilars Initiative Journal (GaBI Journal). 2019;8(1):24-31. doi:10.5639/gabij.2019.0801.003

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2022 Pro Pharma Communications International. All Rights Reserved.

Source: IQVIA [1]

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment