How the biosimilars market in Europe has changed and what opportunities for biosimilars exist for the near term in the region is being reviewed by Murray Aitken in this article [1].

Biosimilars market and opportunities in Europe

Home/Reports

|

Posted 17/05/2019

2

Post your comment

2

Post your comment

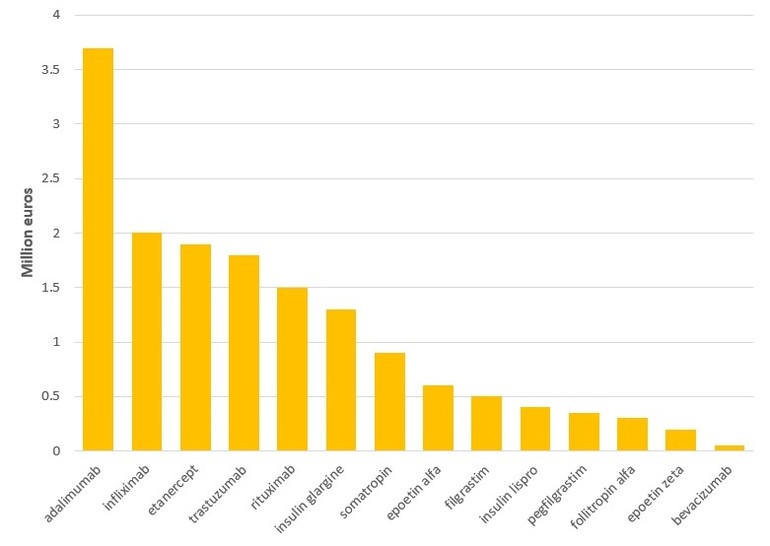

The share of the European Union’s biologicals market that is subject to competition from biosimilars has increased from 9% back in 2013 to 29% in 2018. The number of molecules facing competition has also increased, with 14 molecules, worth a staggering Euros 49.9 billion of the biologicals market in 2018 facing competition from biosimilars, compared to Euros 31.7 billion in 2013, see Figure 1.

Figure 1: Biologicals facing competition from biosimilars

Patient use of biologicals has generally increased following the introduction of biosimilars. Therefore, it makes sense that uptake rates for biosimilars across EU5 (France, Germany, Italy, Spain and the UK) has also generally increased with each subsequent launch. In addition, list and net prices for biologicals (including the originator version) have also fallen following introduction of biosimilars. For example, in Germany, following the introduction of three infliximab biosimilars, the net versus list discounts were: Biosimilar 1, 24%; Biosimilar 2, 30%; Biosimilar 3, 24% and originator 62%. For rituximab, following the introduction of two biosimilars in Germany, the net versus list discounts were: Biosimilar 1, 9%; Biosimilar 2, 7% and originator 16%.

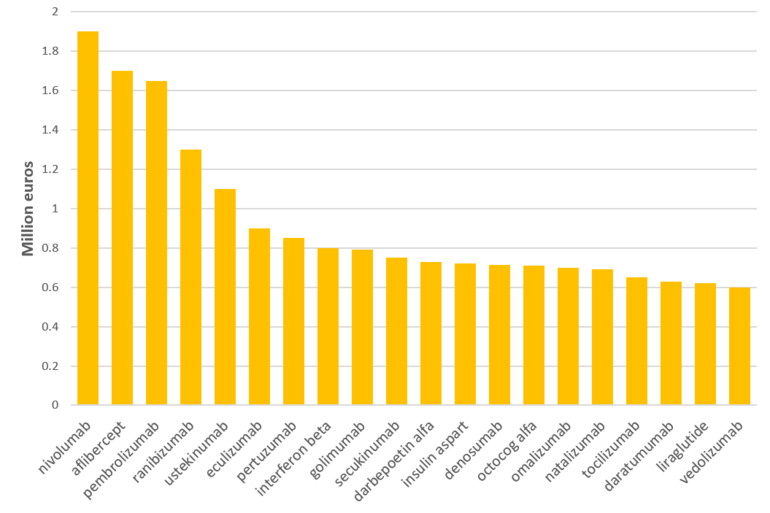

However, despite these positives, the challenge for the future is that fewer new blockbuster biologicals will become available for biosimilar competition over the next five years compared to in the last five years, see Figure 2.

Figure 2: Near-term new biosimilar opportunities

Conflict of interest

The author of the presentation [1] did not provide any conflict of interest statement.

Related articles

Factors contributing to long-term sustainability of biosimilars

The level of biosimilars competition in Europe varies

Challenges for biosimilar sustainability in Europe

Reference

1. Aitken M. Advancing long-term biosimilar sustainability in Europe: the challenges ahead. Medicines for Europe 17th Biosimilar Medicines Conference; 28-29 March 2019; Amsterdam, The Netherlands.

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2019 Pro Pharma Communications International. All Rights Reserved.

Posted 25/08/2021 by Miriam N, GaBI Online Editorial Office

Response to 'Biosimilars market and opportunities in Europe'

Dear Ms Elizabeth,

Thank you for your valuable comment received on 13/7/2021. We have updated Figure 2 of article ‘Biosimilars market and opportunities in Europe’ with the correct information.

We very much appreciate your kind feedback. Thank you for your interest in GaBI, and please continue with your valuable comments to GaBI Online.

Best Regards, Miriam

Posted 13/07/2021 by Elizabeth

Error in Figure 2

Hello,

I think that you have an error in Figure 2. First slope should be named nivolumab not involumab (as it is now).

Best,

Elizabeth

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment