When the European Commission (EC) was created, one of the founding principles was that of free trade. There should be no barriers to trade within ‘the common market’ as it was called at the time. The Competition Commissioner has previously examined parallel importing in the pharmaceutical sector and has the power to impose large fines.

EU investigation tackles pay-for-delay

Home/Reports

|

Posted 09/12/2011

0

Post your comment

0

Post your comment

This is the first of three articles on the EU pharmaceutical sector enquiry.

Introduction

In 2009, the EC reported on an investigation into patent settlements between originator and generics companies. The background to this was firstly the US situation in which the Federal Trade Commission and FDA came to the conclusion that serious breaches of US antitrust laws were being committed in the 1990s and early 2000s. Additionally, many large companies were approaching the patent cliff in Europe at which their patents would expire and generics competition would be allowed. In view of the very large sums of money being generated by the originator products, it was considered that American litigious practices were spreading to Europe. Indeed, the numbers of patent settlement agreements in 2000–2002 were comparatively low, see Figure 1, whereas thereafter a significant increase can be observed with three peaks: 53 settlements in 2005, 73 in 2009 and 89 in 2010.

Figure 1: Number of patent settlements and International Non-proprietary Names (INNs) (2000–2010)

Source: Pharmaceutical Sector Inquiry

Legislation regulates company behaviour

Antitrust laws are those designed to prevent hindrance to free competition. So, whenever two companies come to an agreement for their common good, the activity concerned inherently has anticompetitive potential. The most common situation is if companies agree to refrain from competing in any important area such as price, quality, innovation, territory or product field. A monopoly situation is not usually involved. In fact, a patent is already an exception to the right of access to a free and open market, but is granted to encourage innovation in controlled conditions. Therefore, patents are granted for the public good, but they also create tempting opportunities for anticompetitive behaviour.

The effect of generics entry

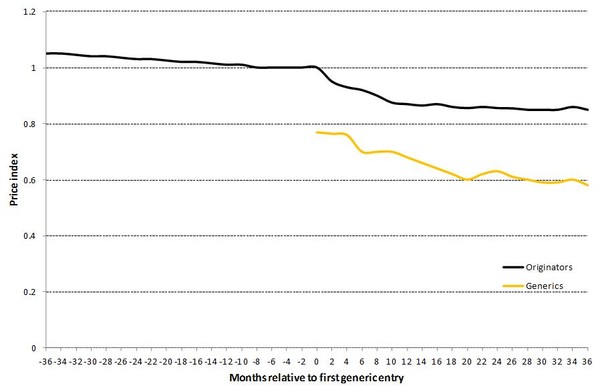

Based on a sample of medicines that faced generics entry in the period from 2000–2007, the EC’s preliminary report found that generic medicines enter the European market at a price that was, on average, about 25% lower than the price set by originator companies prior to loss of exclusivity, e.g. patent expiry. Prices of generic medicines, after they have been available on the market for two years, are on average 40% lower than the former price of the medicine of the originator company. The average prices of originator companies also go down somewhat. The percentages are larger in the US, but on both sides of the Atlantic the sooner several generics companies offer a product, the greater the price competition and the lower price consumers pay [1].

These developments are illustrated by Figure 2.

Figure 2: Development of originator and generics price indices for medicines with generics entry

Note: The originator price index is set equal to one 6 months before loss of exclusivity.

Source: Pharmaceutical Sector Inquiry (partially based on IMS data)

It is therefore in the consumer’s interest to be able to buy generic versions of medicines as soon as possible and the Commission acts in the interests of the general public.

Patent litigation postpones generics entrance

Since patents (legal protection) are involved, an attempt to start marketing a generic drug will often start with a lawsuit. It itself, a protracted legal struggle, delays the introduction of the competitor drug. The 2009 EU factsheet states that between 2000 and 2007 the duration of patent litigation varied considerably between Member States with an average duration of 2.8 years. The majority of court cases were initiated by originator companies. However, generics companies won the majority of cases in which a final judgment was given (62%). Originator companies asked for interim injunctions in 225 cases, obtaining them in 112 cases. The average duration of the interim injunctions granted was 18 months.

In the US, the first company to market a generic drug once a patent has expired gains 180-day exclusivity before other companies can market the same medicine. So, if patent protection is extended, delaying generics entry, the originator and generics challenger share the wealth. The originator pays the first generics company to delay market entry, thereby prolonging its monopoly position. This is just fine for the generics company too, and the practice is common enough to have a name: pay-for-delay.

The problem with out-of-court settlements

It is not necessarily bad for companies to reach agreements over the interpretation of patents, even if the new entrant agrees to pay compensation to the patent holder. Such agreements may eliminate a barrier to the new entrant and allow both companies to compete, albeit if one is paying royalties to another. If a conclusion is imposed by legal judgement, an antitrust interpretation is unlikely. However many lawsuits are settled out of court, and there is no obligation on the companies involved to disclose the terms of their agreement. Such settlements may align the companies’ interests against those of the consumer.

The EU investigation queried out-of-court settlements on two main criteria, firstly whether the agreement foresees a limitation on the generics company's ability to market its own medicine and secondly whether the agreement foresees a value transfer from the originator to the generics company.

The most straightforward limitation occurs when the settlement agreement contains a clause explicitly stating that the generics company will refrain from challenging the validity of the originator company's patent(s) and/or refrain from entering the market until the patent(s) have expired. A licence granted by the originator company allowing market presence of the generics company is also categorised as limiting generics entry, because the generics company cannot enter the market with its own product or it cannot freely set the conditions for the commercialisation of its product. Other limitations are also possible.

A value transfer may also take many forms, indeed a straightforward payment is no longer used as it obviously attracts criticism. In a distribution agreement or side-deal the originator company grants a commercial benefit to the generics company, for example, by allowing it to enter the market before patent expiry in another geographical area or by allowing market entry with another product marketed by the originator company. A value transfer could furthermore consist of granting a licence to the generics company enabling it to enter the market.

Results

The Commission was able to report a decrease in the number of potentially anti-competition out-of-court settlements following a second round of monitoring activities. A further article will report on the Commission’s activities and success in more detail.

The industry is taking the EU action seriously.

Related articles

Problematic pharma patent settlements decrease in the EU

How originator companies delay generic medicines

European Commission investigates Johnson & Johnson and Novartis over delaying generics

Problematic patent settlements in EU on the decrease

European Commission to investigate patent settlements again

Reference

1. Mavroghenis S. Article 82 EC and strategic patenting – patent thickets, defensive patents, and follow-on patents. 2009 January 14. [cited 2011 December 09]. Available from: www.droit.ulg.ac.be

Source: European Commission

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment