The European Union (EU) and the US risk being locked into higher drug prices during negotiations for the Transatlantic Trade and Investment Partnership (TTIP), according to a joint report released by Health Action International (HAI), the Commons Network and Public Citizen.

TTIP could further delay access to generics

Home/Policies & Legislation

|

Posted 11/11/2016

0

Post your comment

0

Post your comment

The report warns the EU and the US to resist pressure from pharmaceutical corporations and advises against including an intellectual property (IP) chapter in the TTIP. It finds that the proposals in the current TTIP may lock in, or even expand, IP protection, strengthening monopoly protection periods thus obstructing progress towards sustainable access to medicines by further delaying price-lowering competition from generics.

In Europe, similar to the US, on top of the 20-year patent protection period, additional market exclusivity, data exclusivity and supplementary protection certificates further delay price-lowering competition from generics. Patents have been argued to be a way to protect and stimulate innovation. However, according to the report, ‘research suggests patents on medicines are proving an expensive way for societies to stimulate innovation’. In fact, ‘the European Commission has recognized that IP protection can, in fact, inhibit innovation because excessive patenting of both compounds and research tools hinders follow-on public and private research’.

Adding another layer of enforceability through a trade agreement on existing practices in the EU and the US on secondary patenting, warns the report, ‘will block the possibility to change these disputed IP practices in the future’.

The report points to the example of India, where minor variations to existing products are not considered inventive when there is no significant difference in its properties with regard to efficacy. This means that India does not allow for secondary patenting. The EU currently does not have this requirement. However, the authors of the report believe that ‘from a public health and cost-savings perspective, this would be a rational practice for the EU or individual Member States to adopt, because it would encourage generics competition, which brings down medicines prices’.

Another area where the authors are ‘concerned about the impact of locking in or strengthening current protection levels’ is in the areas of ‘data exclusivity and market exclusivity’. These, say the report, ‘may prolong the monopoly protection period for the originator companies after the patent has expired, or grant exclusivity where there is no (or weak) patent protection. During the data exclusivity period, generics manufacturers may not refer to the marketing authorization data when seeking to register their generic medicines. Impact studies confirm that data and market exclusivity have a direct impact on medicines prices. Moreover, instead of spurring innovation, long periods of exclusivity may block innovation as they prohibit incremental innovation by competitors’.

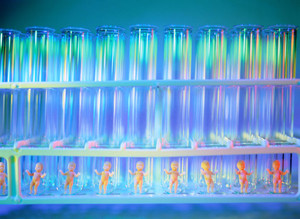

Considering biologicals, the EU currently has eight years of data exclusivity plus two years of marketing exclusivity plus one extra year for new indications (8 + 2 + 1 = 11 years total). The US, on the other hand, has four years of data exclusivity and eight years of marketing exclusivity for biologicals (4 + 8 = 12 years total). For biologicals, competition from biosimilars is even more crucial than for ‘traditional’ small-molecule medicines. This is because biologicals are expensive and prices far exceed the most costly classic small-molecule medicines – on average 20 times more. In 2014, biologicals accounted for 27% of pharmaceutical sales in Europe and their percentage of the pharmaceutical drug market is expanding. Biosimilar market entry generally results in significant cost savings as biosimilars are on average 30% lower in price. Should the EU and the US decide to harmonize exclusivity periods for biologicals, this may lead to one additional year of exclusivity in the EU. Given the high price tag of new biologicals, any extra year of monopoly will result in huge extra costs for societies.

The report also expresses concern that US pharmaceutical companies could attempt to undermine European pricing and reimbursement regimes through the ‘Regulatory Cooperation chapter’. The TTIP could include rules that pharmaceutical companies could use to ‘block, slow, undermine and repeal European regulations’, in order to keep medicine prices high.

The report concludes that the TTIP proposals ‘– less transparency on the benefits and harms of medicines, longer monopolies and pressure on pricing policies – are extremely harmful for LMICs [lower and middle-income countries]’.

Health Action International, Commons Network and Public Citizen believe that ‘secretive “trade”, negotiations are absolutely unacceptable forums for devising binding rules that change national nontrade laws including on intellectual property and medicines regulation’.

They recommend that the EU and the US should:

- recognize the limits of IP protection as a driver of biomedical innovation

- ensure that innovation and biomedical knowledge, derived in whole or in part from publicly funded health R & D, results in medical products that are appropriate, affordable and accessible at prices that reflect the public contribution

- ensure that publicly-funded research results are made publicly available, including by enabling knowledge sharing through intellectual property management that allows for open data and equitable licensing

- further explore and implement alternative incentive models for biomedical innovation that incorporate the principle of ’delinking’ R & D costs from end product prices.

Related article

How will biosimilars be affected by the TPP

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2016 Pro Pharma Communications International. All Rights Reserved.

Source: Europa, Health Action International

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

WHO to remove animal tests and establish 17 reference standards for biologicals

Home/Policies & Legislation Posted 07/01/2026

ANVISA tackles 24-month backlog in biologicals post-registration petitions

Home/Policies & Legislation Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment