The global market for generic drugs was worth an estimated US$84 billion for 2009 and is expected to increase to a staggering US$168.7 billion by 2014.

The global generic medicines market

Home/Pharma News

|

Posted 03/09/2010

0

Post your comment

0

Post your comment

The US is still the leading market for generic drug sales; however Japan is hot on their heels.

In the US generic drug sales were estimated to be US$33 billion in 2009 and are projected to increase to US$54 billion by 2014.

Japan is currently the second largest generic drug market and is expected to have the highest rate of growth, at 12.2%, among all the major markets. Sales are expected to increase from US$5.4 billion in 2009 to US$9.6 billion by 2014.

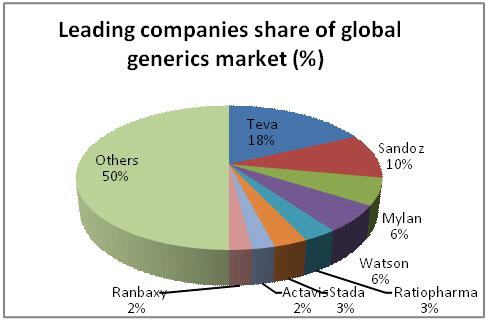

This seems to be a very lucrative market with good prospects for the future. However a report by US market data provider BCC Research shows that this is also a bit of an exclusive club. The top four global generics manufacturers in 2009 – Teva, Sandoz, Mylan and Watson – accounted for 40% of the world market.

Teva with an 18% market share in 2009, is reinforcing its global number one position with the recent acquisition of the 5th largest generic manufacturer, Ratiopharm. This move has increased both its global position and has propelled it to the number one position in Europe.

Teva's President and CEO, Mr Shlomo Yanai, commented that “increasing Teva's market share in Europe – a geography with tremendous potential for generics penetration – is an important pillar of our long-term growth strategy. With the acquisition of Ratiopharm we will become the leader in key European markets and we are well-positioned to become the leader in many other European markets in the near future".

References:

BCC Research. Generic Drugs: The Global Market. Report Code: PHM009E, Published: July 2009

Teva Press Release. Teva Completes Acquisition of ratiopharm. 10 August 2010

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

Formycon signs new aflibercept biosimilar pacts and launches ranivisio in Europe

Home/Pharma News Posted 13/11/2025

Bio-Thera and Stada expand biosimilars alliance to include tocilizumab

Home/Pharma News Posted 20/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment