On 18 March 2010 Teva announced that it has entered into a definitive agreement to acquire ratiopharm, Germany's second largest generics producer and the sixth largest generic drug company worldwide, for an enterprise value of Euros 3.625 billion. The transaction is subject to certain conditions including relevant regulatory approvals. On a pro forma basis, the combined company would have had 2009 revenues of US$16.2 billion. Teva expects to complete the transaction by year-end 2010.

Teva with ratiopharm market leader in European generics

Generics/News

|

Posted 26/03/2010

0

Post your comment

0

Post your comment

Commenting on the transaction, Mr Shlomo Yanai, Teva's President and Chief Executive Officer, said: "This is an important acquisition for Teva. This transaction is perfectly aligned with our long-term strategy in which Europe is an important pillar and growth driver. Ratiopharm will provide us with the ideal platform to strengthen our leadership position in key European markets, most notably in Germany, as well as rapidly growing generic markets such as France, Italy, and Spain."

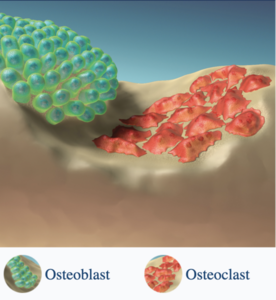

The acquisition will position Teva as the leading generic pharmaceutical company in Europe, increasing its European business from sales of US$3.3 billion in 2009 to joint pro forma sales of US$5.2 billion. Ratiopharm's robust portfolio includes 500 molecules in over 10,000 presentation forms covering all major therapeutic areas marketed in 26 countries. Ratiopharm also has valuable know-how in biosimilars, consisting of a number of products in advanced stages of development and a well-established sales and marketing team. Teva has taken steps over the last year to position itself as a major player in the biosimilars game - despite the lack of a regulatory pathway in the US it linked a deal with Lonza Group in January 2009 to establish a joint venture to develop, manufacture and market a portfolio of biosimilars. And in December 2009, it submitted a BLA for XM02, which was principally developed as a similar biological medicinal product to Amgen's Neupogen.

Ratiopharm reported worldwide 2009 revenues of Euros 1.6 billion. The combined entity will have 40,000 employees worldwide, of which 18,000 will be based in Europe. The German headquarters site for the combined entity will be located in Ulm, ratiopharm's current headquarters.

Following the acquisition, Teva will improve its market position in Germany, the world's second largest generic drug market valued at approximately US$8.8 billion (including sales to hospitals and OTC), to become the number two player in this market. The combined entity will have a strong European footprint, holding the leading market position in 10 European markets, including key markets such as Hungary, Italy, Portugal, Spain, The Netherlands and UK, and as well as a top three ranking in 17 countries, including the Czech Republic, France, Germany and Poland. In addition, the transactions will nearly double Teva's sales in Canada.

Mr Yanai continued, "We are highly impressed by the team at ratiopharm and thrilled to be joining forces with a company we have partnered with in the past and have long respected. Teva and ratiopharm have similar corporate cultures and share a strategic vision, which makes this combination a natural fit. Together, we will be able to realize the vision of increasing patients' access to safe, high-quality, affordable medications even more quickly and deliver even more value to our stakeholders across the globe."

References:

Teva to Acquire Ratiopharm. Teva Press Release. 2010 March 18.

VEM sells ratiopharm Group to Teva – ratiopharm to become the hub for Teva’s European growth strategy. ratiopharm press release. 2010 March 18.

Liz Jones. Teva comes out on top with $5B Ratiopharm bid. FiercePharma. 2010 March 18.

Source: Teva Press Release; ratiopharm press release; FiercePharma

Research

Japan’s drug shortage crisis: challenges and policy solutions

Saudi FDA drug approvals and GMP inspections: trend analysis

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment