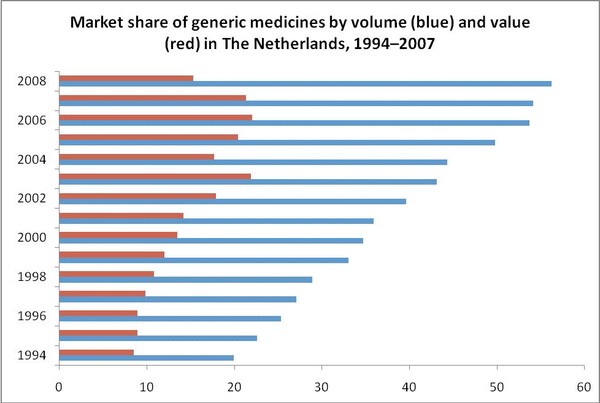

The Dutch generic medicines market has grown rapidly over time, with public expenditure increasing from Euros 185 million in 1994 (market share by value of 8.5%) to Euros 830 million in 2004 (market share by value of 17.7%) and to up to approximately Euros 977 million in 2007 (market share by value of 21%). Introduction of various policies by both the government and health insurance companies reduced public expenditure in 2008 to Euros 711 million (market share by value of 15%) [1].

The market share of generic medicines by volume (prescriptions) is more than doubled from 19.9% to 44.3% between 1994 and 2004, and reached 56% in 2008 [2-4].

Sources: 1994–2004 [4], 2005–2008 [5].

Highlights of the Generics Market in The Netherlands

- Market share of generic medicines by volume is more than 56%, less than 15% in value.

- Substitution by pharmacist is allowed if patients and physicians agree [6], and is encouraged by the government and by many health insurance companies.

- The financial attractiveness of generics substitution by pharmacists has in the past sustained generics use, however, mainly due to the preference policy and the loss of purchase benefits for pharmacists, the future is now unclear.

- Free pricing, but maximum price level at average EU price level (Belgium, France, Germany, UK).

- Competition in generic medicines is margin driven.

- Prescribing by international non-proprietary name (INN) is encouraged, supported by prescribing software [7], however, medical students are not taught to prescribe by INN.

- A range of financial and non-financial incentives for physicians support generic prescribing.

- Covenant agreements between the government, health insurance companies, pharmacies and industry (health insurance funds) have agreed generics substitution target rates in consultation with pharmacists.

- In 2007, savings were approximately Euros 971 million [3].

- In 2008, savings were expected to increase by Euros 340 million, bringing total savings to Euros 1,311 million [3].

Market Developments in The Netherlands

- Increased role of healthcare insurance companies with introduction of the preference policy

- Unclear governmental policy after the end of the covenant (December 2007)

- Fast growth of pharmacy chains

- Introduction of new reimbursement rules

- Limited growth potential in the generic medicines industry for the next years

Market Opportunities in The Netherlands

- Increased generic prescribing by doctors

- Increasing awareness of patients

- Co-payment by patients

- Alliance with new players

- Introduction of incentives for stakeholders

References

1. Bond van de Generieke Geneesmiddelenindustrie Nederland (Bogin), Information in English [page on the Internet]. The Hague, The Netherlands, Bogin [cited 2011 May 13]. Available from: www.bogin.nl/english

2. Griens AMGF, Tinke JL, van der Vaart RJ, editors. Facts and Figures 2008 [monograph on the Internet]. The Hague, The Netherlands, Stichting Farmaceutische Kengetallen (SFK) [cited 2011 May 13]. Available from: www.sfk.nl/algemeen/2008fandf

3. Griens AMGF, Janssen-Hoge JM, van der Vaart RJ, editors. Data en feiten 2009 [Dutch] [monograph on the Internet]. The Hague, The Netherlands, Stichting Farmaceutische Kengetallen (SFK) [cited 2011 May 13]. Available from: www.sfk.nl/publicaties/2009denf.pdf

4. Simoens S, De Coster S. Sustaining Generic Medicines Markets in Europe. April 2006. [monograph on the Internet]. Brussels, Belgium, European Generic Medicines Association (EGA) [cited 2011 May 13]. Available from: www.egagenerics.com/doc/simoens-report_2006-04.pdf

5. Stichting Farmaceutische Kengetallen (SFK), Jaaroverzicht Data en Feiten. [Dutch] [page on the Internet]. The Hague, The Netherlands, Stichting Farmaceutische Kengetallen (SFK); c2010 [cited 2011 May 13]. Available from: www.sfk.nl/publicaties/data_en_feiten.html

6. Federaal Kenniscentrum voor de Gezondheidszorg (Belgian Healthcare knowledge centre, KCE). The reference price system and socioeconomic differences in the use of low cost drugs. KCE reports 126C. 2010.

7. Österreichisches Bundesinstitut für Gesundheitswesen (ÖBIG). Rational use of medicines in Europe. February 2010.