First posted: 20 April 2012

In the context of a generic medicines policy that consists of some supply-side measures, but no demand-side measures, the Austrian generic medicines market has developed slowly over the years [1].

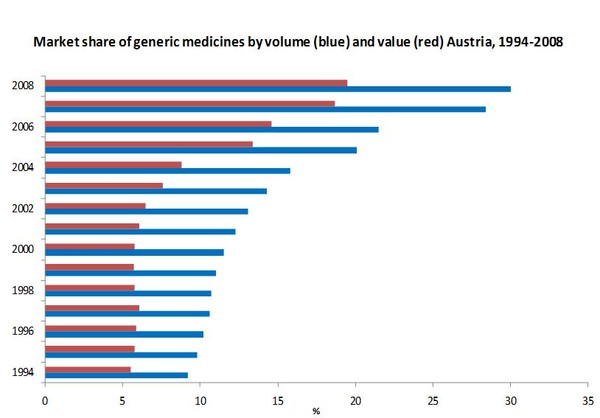

Market share of generic medicines has grown from 5.5% in 1994 to 19.5% in 2008 in terms of value of consumption and from 9.2% in 1994 to 30.0% in 2008 in terms of volume of consumption [1, 2].

Sources: 1994–2004 [1], 2005–2008 [2].

Austria has pricing regulation of generic medicines, which means that penetration of generic medicines is less successful than in countries that permit (relatively) free pricing of medicines, e.g. Germany, The Netherlands, UK [3].

One of the reasons for the relatively low market share of generics is that neither voluntary nor obligatory generics substitution is allowed for pharmacists. There are no plans to introduce generic substitution in near future.

There are no financial incentives for patients to ask the physician to prescribe a generic drug, however, information campaigns to promote generics have been organised by the Austrian Generics Association (Österreichische Generikaverband, OEGV) in cooperation with the Main Association of Austrian Social Security Institutions (Hauptverband der österreichischen Sozialversicherunsträger, HVB) and by individual sickness funds [4].

Physicians in Austria are not allowed to prescribe by international non-proprietary name but have to use the brand name or the generic drug name [4].

Highlights of the generics market in Austria

- Generics competition creates, through continuous price reductions, long-term savings for the Austrian healthcare system [5].

- In the last five years, total savings of around Euros 360 million have been brought about by the use of generic drugs [1].

- Since 2004, substantial price differences between originator and generics in developing markets have stimulated market entry [2].

- Market share of generic medicines by prescription is 30%, but only 19.5% in value [2].

References

1. Simoens S, De Coster S. Sustaining Generic Medicines Markets in Europe. April 2006. [monograph on the Internet]. Brussels, Belgium, European Generic medicines Association (EGA) [cited 2012 Apr 13]. Available from: www.egagenerics.com/doc/simoens-report_2006-04.pdf

2. Association of the Austrian Pharmaceutical Industry (Pharmig). Medicinal products and health care in Austria: Facts 2008/Edition 2010.

3. Simoens S. Generic medicine pricing in Europe: current issues and future perspective. J Med Econ. 2008;11(1):171-5.

4. Österreichisches Bundesinstitut für Gesundheitswesen (ÖBIG). Surveying, Assessing and Analysing the Pharmaceutical Sector in the 25 EU Member States. July 2006.

5. Österreichische Generikaverband (OEGV) [Austrian Generics Association]. OEGV Facts. Preisvorteil von Generika. [Price advantage of generics] [monograph on the Internet] Vienna, Austria, BMGFJ [cited 2012 Apr 13]. German. Available from: www.generikaverband.at/media/generika/de_at/OEGVfacts/Facts_Preisvorteil.pdf