The US pharmaceutical industry plays a vital role in shaping the face of American health care. With major patent expiries and thin product pipelines, the industry is now considering new directions to maintain growth and stability. Biological drugs, derived from living organisms, represent a growing opportunity for big pharmaceutical firms. They command high prices, will probably have fewer firms making them than generics due to high barriers to entry, and play to the existing strengths of big pharma firms. But will the recent healthcare legislation provide the way for consistent FDA regulation? What is the most likely way in which biologicals will enter the market over the next few years?

The search for a new developmental model

In recent years, we have witnessed the breakdown of the well-oiled machinery of the traditional big pharma innovation. While R & D departments spent more and more–well over US$1 billion per drug, fewer promising results emerged in the form of late-stage drug candidates. This has recently led to a strategic shift in portfolio management within big pharma companies towards acquisitions to build up their pipeline of drugs. In-house R & D projects have been cut, scientific staff laid off. 2009 bore witness to the most mergers and acquisitions in the pharmaceutical industry to date and the phenomenon continues. The industry is still searching for complementary development projects and synergies in manufacturing and emerging markets.

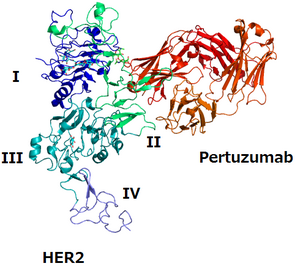

Meanwhile, the biotech industry’s foray into therapeutics has been a great success. From the 1980s to the present, biologicals have reshaped the face of medicine in many disease areas. Enbrel’s is the classic story of the modern biological drug: a novel treatment developed by a small biotech firm and acquired or licensed up the food chain to feed bigger firms’ appetites for late-stage assets.

The regulatory dilemma: how similar are biosimilars

Follow-on biologics that are proven to be ‘highly similar’ to a reference product and meet the relevant regulatory requirements of safety, purity, and potency are considered biosimilar to the reference product. If the marketer of a biosimilar product can prove that there is no increase in risk or diminished efficacy when switching between the reference drug and the follow-on product, the biosimilar product will be deemed ‘interchangeable’. This is the stance intended by the US Biologicals Price Competition and Innovation (BPCI) Act.

The EU adopted a different position, and said it was too difficult to create ‘generic’ biologicals that are interchangeable in the same way as small molecule generics. The EMA requirement for ‘biosimilars’ is drugs that cannot be interchanged by a pharmacist, but can compete with established biological drugs because they will achieve a very similar effect, whichever is prescribed.

The patent position

Many differences exist between the intellectual property provisions in the BPCI Act and the legislation covering the abbreviated pathway for small molecule drugs, commonly referred to as the Hatch-Waxman Act. Perhaps the most notable difference is that the biosimilar legislation does not mandate a listing of relevant patents that reference sponsors claim protect approved products.

Patent challenges were written into the previous legislation but are not included in the same way in the BPCI Act. Companies seeking approval for a biosimilar or interchangeable product may have to navigate a new methodology of patent litigation that will require expertise and foresight. The strategies associated with patent challenges for small-molecule products may not apply. It is likely to take at least five years to almost a decade before there is any case law developed enough to test the effectiveness of these provisions [1]. Litigation already costs a fortune in the US, and it is possible that firms will seek to avoid it in future. It is not clear how litigation may be used under the BPCI Act, so going down the BPCI Act route may be like entering a minefield.

The period of market exclusivity granted by the authorisation process is meaningless, because patents generally run for longer than that anyhow.

All of the above means that few applications have so far been made under the BPCI Act, although extensive consultations are in progress between FDA and industry. Minds are turning towards other possibilities that may be cheaper, quicker or have other advantages.

Alternative approaches to gain regulatory approvals

Alternative A: file a BLA (Biologic License Application)

The information and expenditure required to successfully complete the abbreviated pathway may remain uncertain, even after the first biosimilar is approved in the US. In contrast, the costs associated with gaining approval for a BLA are clearer, as are the benefits. Drug sponsors choosing to file a BLA receive their own 12 years of exclusivity, if approved. Additionally, companies can file a BLA at any time, whereas they have to wait four years after the reference product’s first approval date before filing an abbreviated BLA. Major generics companies with established experience in biosimilar development may opt to ignore the main pathway set out in the BPCI Act even with the abbreviated regulatory pathway. It might also be easier to go for a biobetter down the BLA route, than an interchangeable drug via the BPCI Act [2].

Major generics companies started pursuing the US biological market even before the establishment of the biosimilar pathway. Currently, both Teva and Hospira have listed clinical trials for biological products in the US market. In late 2009, a BLA was filled by Teva for the granulocyte colony-stimulating factor (G-CSF) Neutroval and accepted by FDA on 2 February 2010. US clinical trials of Hospira’s biosimilar of the reference product Epogen entered phase I in late July 2010.

Alternative B: develop the drug outside the US

Companies looking to make biosimilars in less-regulated markets can expect reduced development costs, the EU is already much cheaper than the US and several pharma firms have now gone down the European biosimilars route, gaining experience with EU legislation.

However, in India, for example, follow-on biologic manufacturers can meet the lower regulatory standards with development costs 90% lower than in the EU. Manufacturers are able to offer products at greatly reduced prices compared with the original biological product. A shorter time to market entry, in addition to lower development costs, may attract major generic players to compete in these emerging markets [3, 4].

A major licensing deal with India’s Biocon has positioned Pfizer in the insulin market [5]. It is expected that generic launches of recombinant human insulin products aspart, glargine and lispro will first occur in emerging markets and that the products will compete in the US at a later date.

Alternative C: rely less on patents

An alternative for biological drug innovators is to eschew patenting altogether and thus avoid the possibility of protracted patent infringement litigation under the statute. Biological drugs are very complex and are generally made in genetically engineered cells that impose their own variabilities–in post-translation modifications such as glycosylation, for example–on the processes used to make such drugs. As a consequence, broad patent coverage for even structurally similar species of the same biological drug are granted infrequently, and even when obtained may be of dubious provenance and reliability. In this case, the innovators might choose to provide as little information as possible to FDA when applying for approval. For example, they may not reveal details of the optimisation of the particular cell line used to produce the biological product. This would be cheaper and the uncertainty produced would provide a clear obstacle to a biosimilar manufacturer which might be a disincentive to trying to produce a biosimilar version of a biological drug.

Where might this leave smaller companies and academic research? Early-stage patents could continue to serve their purpose of providing exclusivity for further development stages and in prohibiting larger, better-funded companies from expropriating early-stage technology. Patents also enable government-funded grantees to reap the benefits of licensing their technology.

Conclusion

The BPCI Act has hardly been implemented since it was passed because it is so complicated. There has even been speculation that the statute was intended to discourage litigation and its labyrinthine, almost Byzantine provisions support this view. It is likely to take at least five years to almost a decade before there is any case law developed enough to test the effectiveness of these provisions.

The unwillingness of biosimilars manufacturers to share sensitive information on production and development may result in alternative approaches to gain regulatory approval. This was probably not what the authors of the Act intended and the future may turn out differently from the past. In particular, the hoped-for price reduction with interchangeables might not come to pass with biosimilars. New strategies based on the BPCI Act regulations are taking time to evolve.

Competition in the biological market is increasing steadily. As the number of biological-based deals continues to grow, biotech companies are under pressure to create more cost-effective technologies. Technological advances may in the long run drive down the cost of biosimilars manufacturing.

Pressure from policymakers and industry leaders to reform the legislation remains, and the demand for price reduction and increased patient access is increasing. If follow-on products can meet or exceed safety and efficacy requirements, additional pressure will be put on policymakers to amend the current legislation to make it easier to get biosimilar products to market.

Related articles

US biosimilars: many barriers to overcome

Opportunities for biosimilars in emerging markets

References

1. Evans I. Follow-on biologics: a new play for big pharma: Healthcare 2010. Yale J Biol Med. 2010;83(2):97-100.

2. GaBI Online - Generics and Biosimilars Initiative. Biosimilars or biobetters–what does the future hold [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Feb 24]. Available from: www.gabionline.net/Biosimilars/Research/Biosimilars-or-biobetters-what-does-the-future-hold

3. Bourgoin AF. What you need to know about the follow-on biologic market in the US. Thomson Reuters White Paper. 2011 Jan. Available from: thomsonreuters.com/content/science/pdf/ls/newport-biologics.pdf

4. GaBI Online - Generics and Biosimilars Initiative. Biotech growth and biosimilar opportunities in India [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Feb 24]. Available from: www.gabionline.net/Biosimilars/General/Biotech-growth-and-biosimilar-opportunities-in-India

5. GaBI Online - Generics and Biosimilars Initiative. Pfizer and India-based Biocon make biosimilar insulin deal [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2012 Feb 24]. Available from: www.gabionline.net/Biosimilars/News/Pfizer-and-India-based-Biocon-make-biosimilar-insulin-deal

Source: Forbes, Patent Docs

0

0

Post your comment